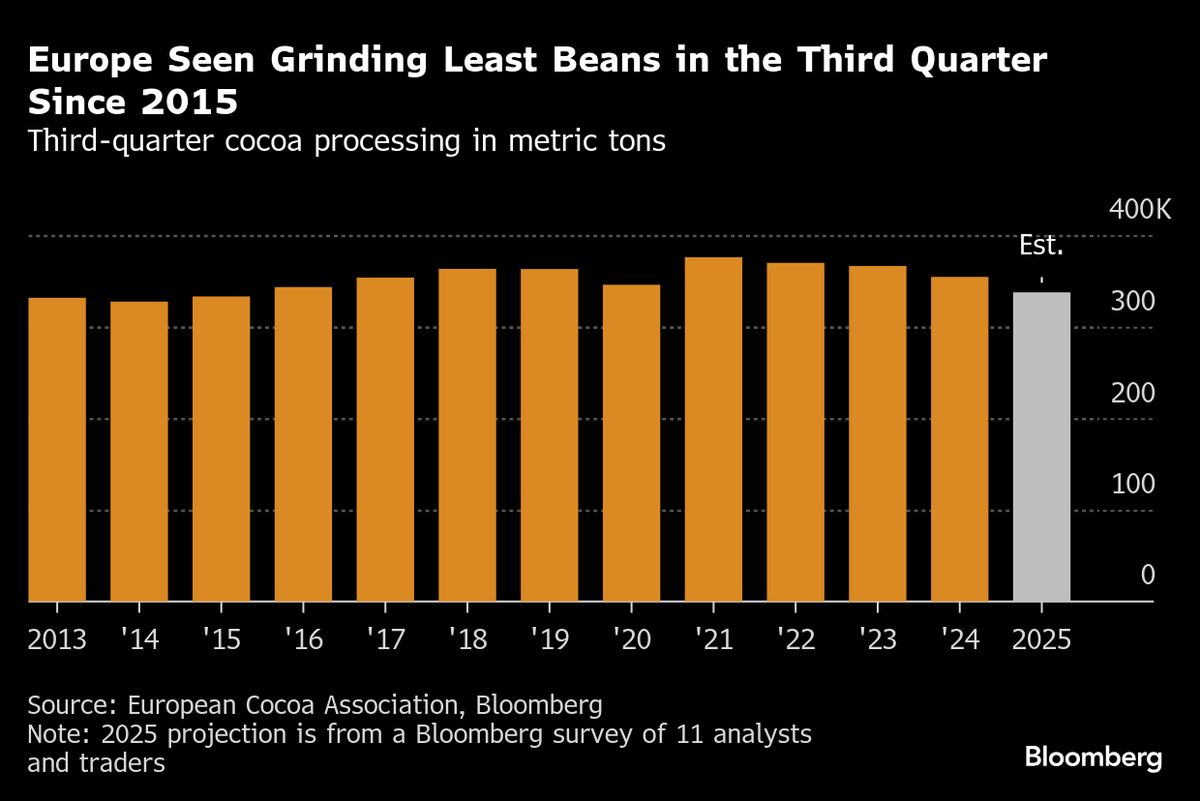

Chocolate Demand Worsens Even as Cocoa’s Historic Rally Fades

NegativeFinancial Markets

The global cocoa industry is facing a significant slowdown, as factories continue to struggle with the aftermath of last year's price surge. This decline is affecting processors' profits and suggests that consumers may not see a decrease in the cost of chocolate anytime soon. It's a concerning trend for both manufacturers and chocolate lovers, as the lingering effects of high cocoa prices could mean that sweet treats remain expensive for the foreseeable future.

— Curated by the World Pulse Now AI Editorial System