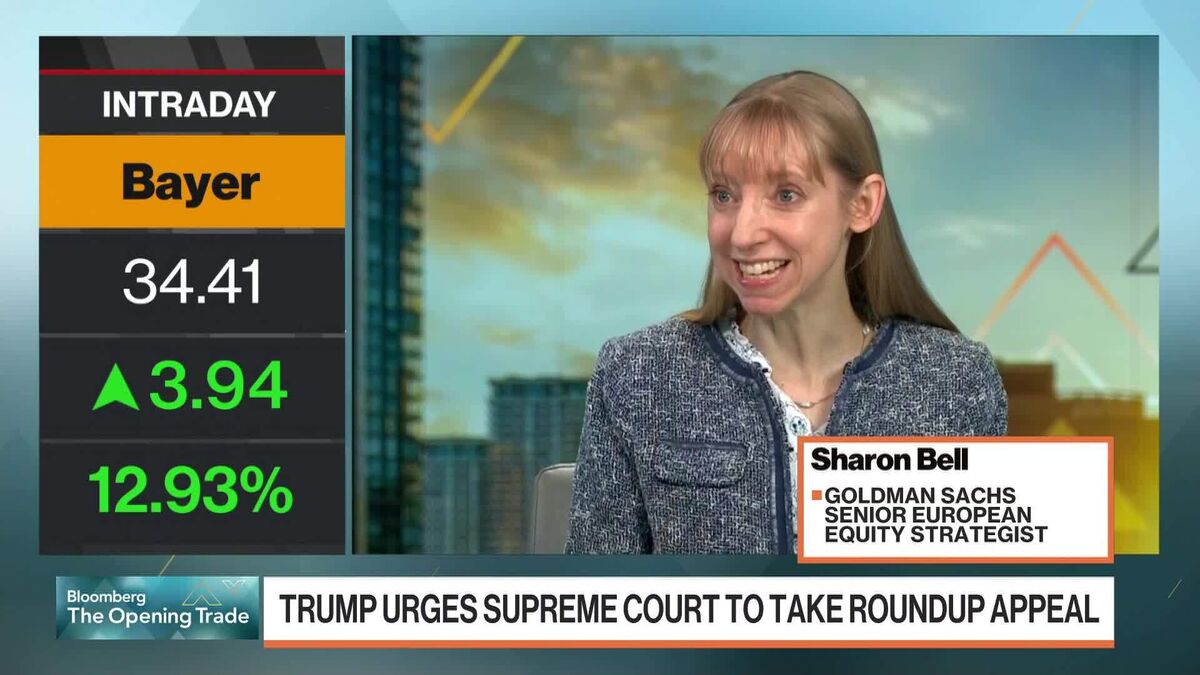

Europe Still Has Good Value, Goldman's Bell Says

PositiveFinancial Markets

- Sharon Bell, senior European equity strategist at Goldman Sachs, asserts that Europe continues to present good value compared to the US, despite a narrowing valuation gap. She notes that quality stocks on both sides of the Atlantic have underperformed this year and may face further challenges if the dollar continues to decline.

- This perspective from Goldman Sachs is significant as it highlights the potential for European equities to attract investors seeking value amidst a volatile market environment, particularly as concerns about overvaluation in the US persist.

- The broader market context reveals a cautious sentiment among investors, with recent declines in global markets due to fears of a tech bubble and high valuations. This backdrop underscores the importance of identifying regions like Europe that may offer more favorable investment opportunities.

— via World Pulse Now AI Editorial System