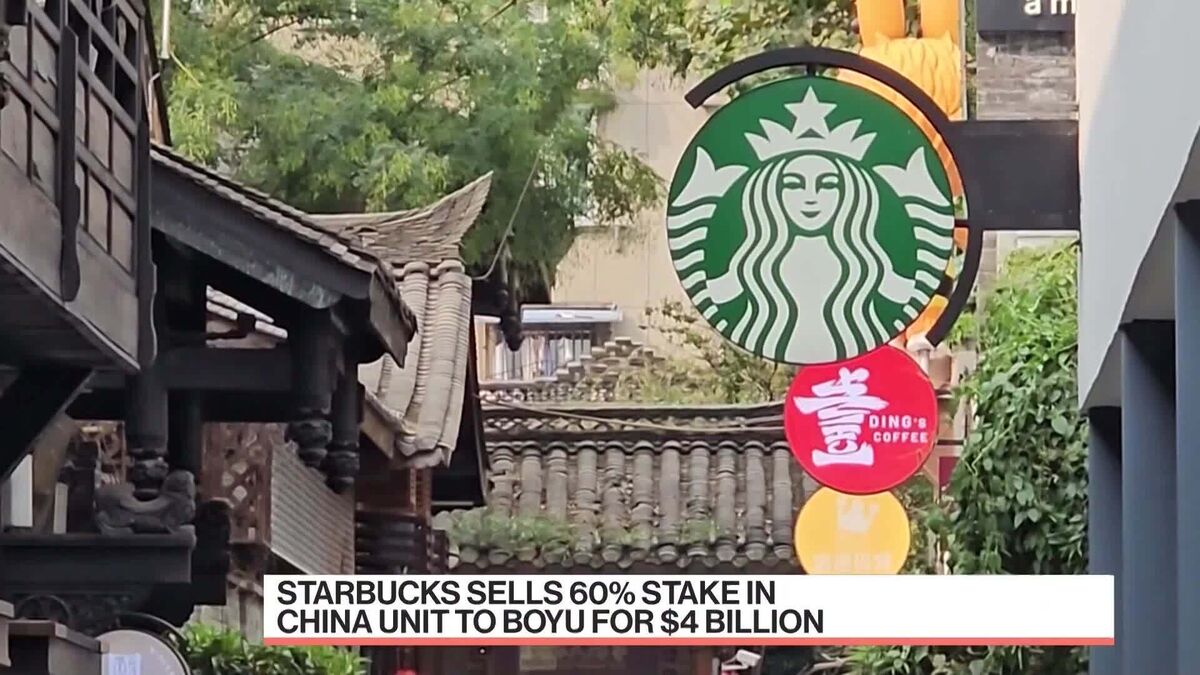

Boyu Seeks $1.4 Billion for Starbucks China Takeover

PositiveFinancial Markets

Boyu Capital is making headlines as it seeks a substantial $1.4 billion loan to acquire a majority stake in Starbucks' China operations. This move highlights the growing interest in China's coffee market and could reshape the competitive landscape. With Starbucks being a major player, this acquisition could lead to new strategies and innovations in the region, benefiting both the company and consumers.

— Curated by the World Pulse Now AI Editorial System