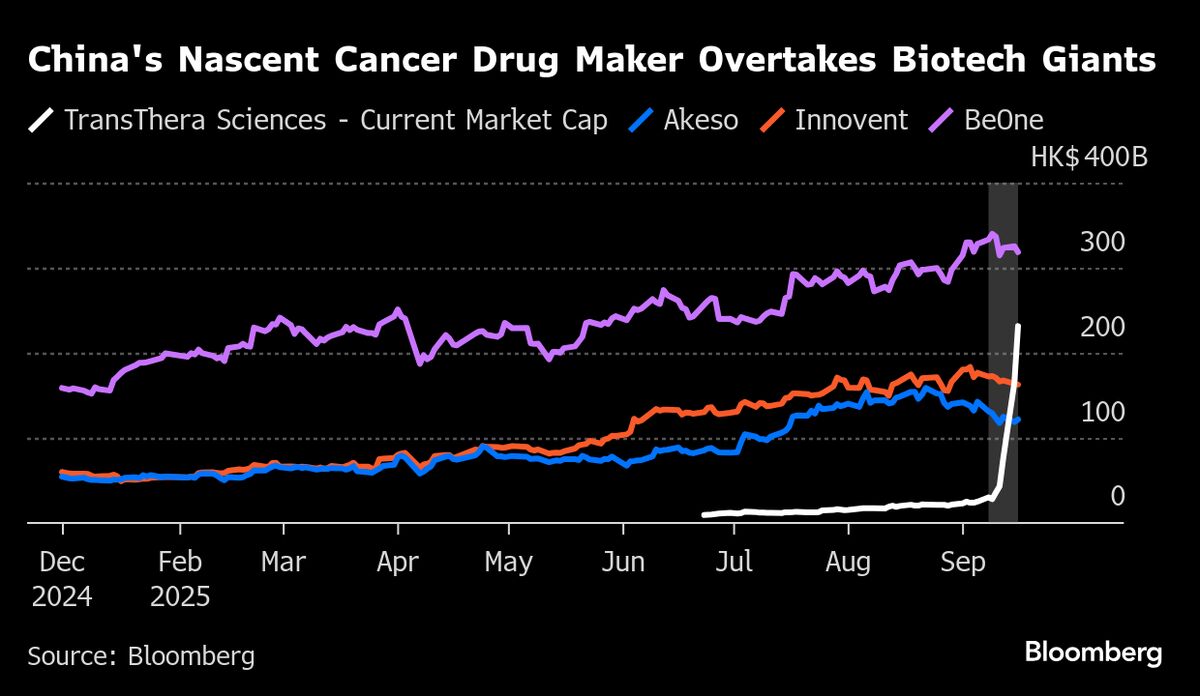

Hong Kong Equity Deals Boom as Chinese Firms Rush to Market

PositiveFinancial Markets

Hong Kong's bankers have seen a surge in equity deals as Chinese companies quickly enter the market to raise funds, marking a strong end to the summer.

Editor’s Note: This boom in equity deals is significant as it indicates a recovery in the financial market and reflects the confidence of Chinese firms in raising capital, which can lead to further economic growth.

— Curated by the World Pulse Now AI Editorial System