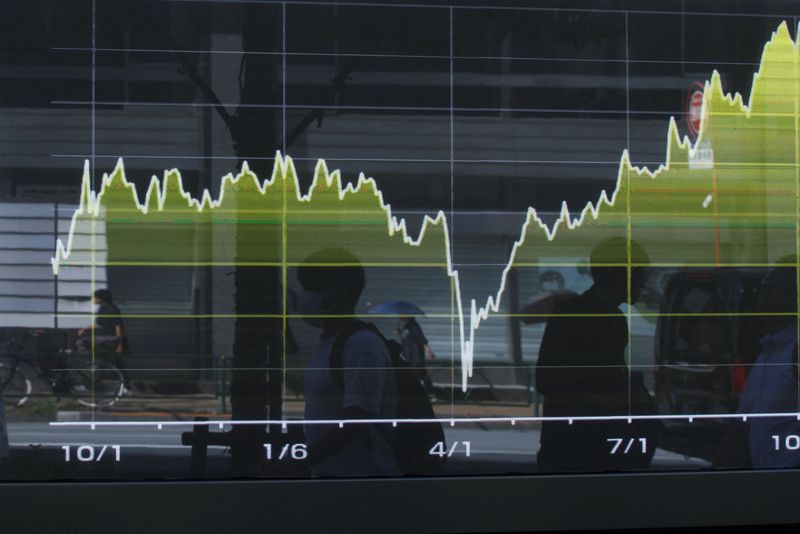

How nervous are investors about the stock market?

NegativeFinancial Markets

Investors are feeling increasingly anxious about the stock market as share prices remain elevated, prompting them to react to any signs of potential trouble. This sentiment is significant because it reflects a growing concern that the current market conditions may not be sustainable, which could lead to volatility and impact investment strategies.

— Curated by the World Pulse Now AI Editorial System