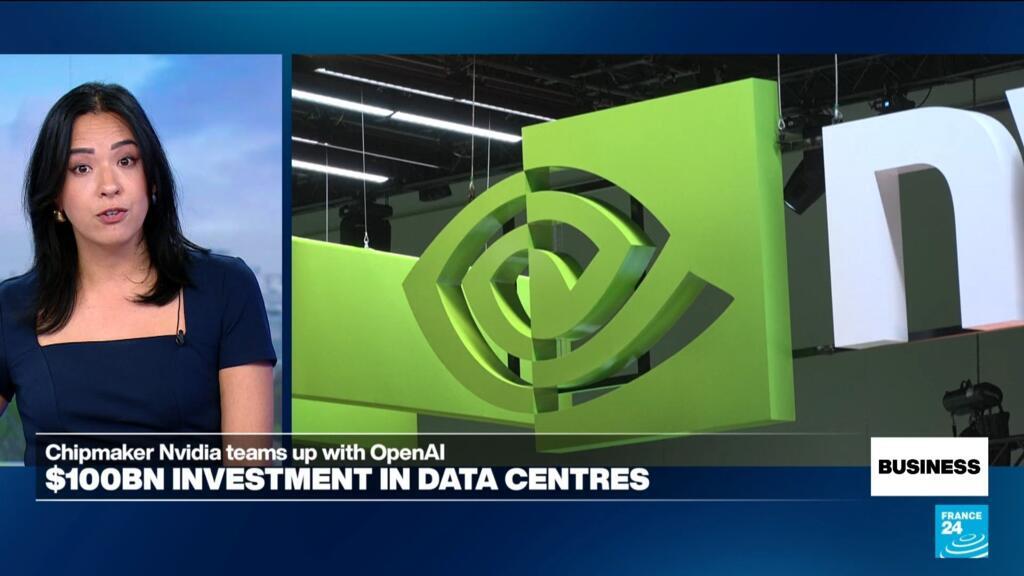

What to Know About Nvidia, OpenAI's $100 Billion Deal

PositiveFinancial Markets

Nvidia's monumental investment of up to $100 billion in OpenAI marks a significant step in the advancement of artificial intelligence infrastructure. This deal not only highlights Nvidia's commitment to AI but also underscores the growing importance of robust data centers in supporting innovative technologies. As AI continues to evolve, this partnership could lead to groundbreaking developments that impact various industries, making it a crucial moment for tech enthusiasts and investors alike.

— Curated by the World Pulse Now AI Editorial System