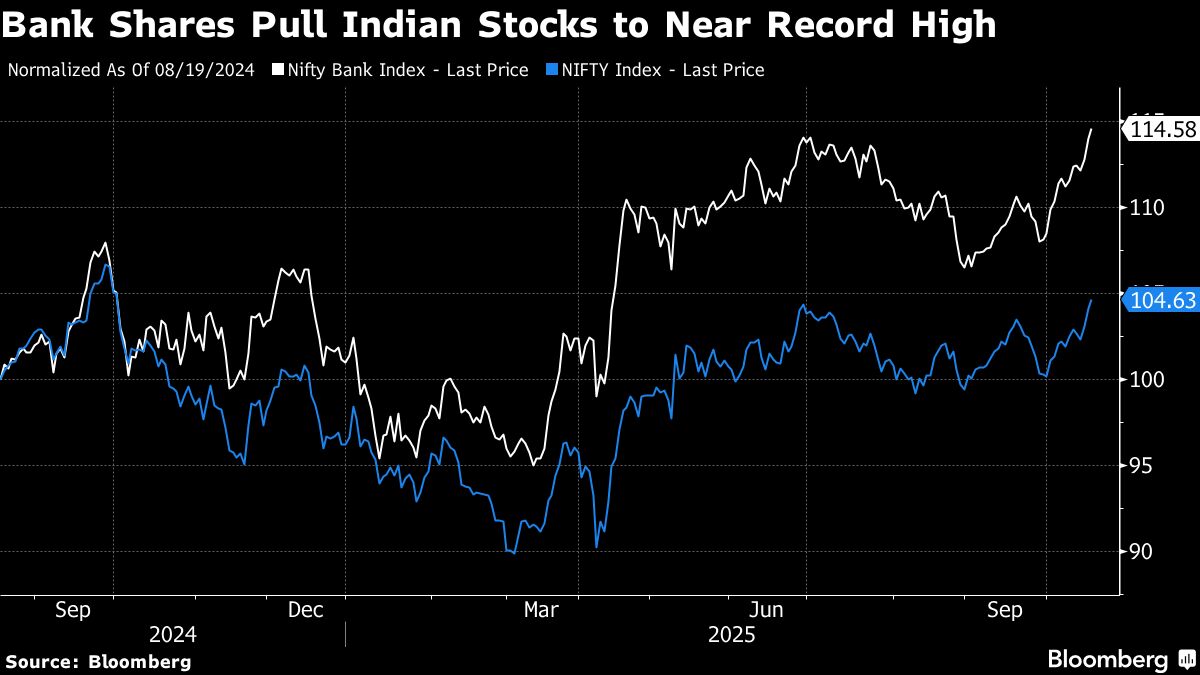

Asian stocks soar as trade tensions, credit worries ease

PositiveFinancial Markets

Asian stocks have surged as concerns over trade tensions and credit worries begin to ease, signaling a potential recovery in the market. This positive shift is crucial as it reflects growing investor confidence and could lead to increased economic activity in the region, benefiting businesses and consumers alike.

— Curated by the World Pulse Now AI Editorial System