Retail Investors Set to Buoy Stocks Into Year-End, JPMorgan Says

PositiveFinancial Markets

Retail Investors Set to Buoy Stocks Into Year-End, JPMorgan Says

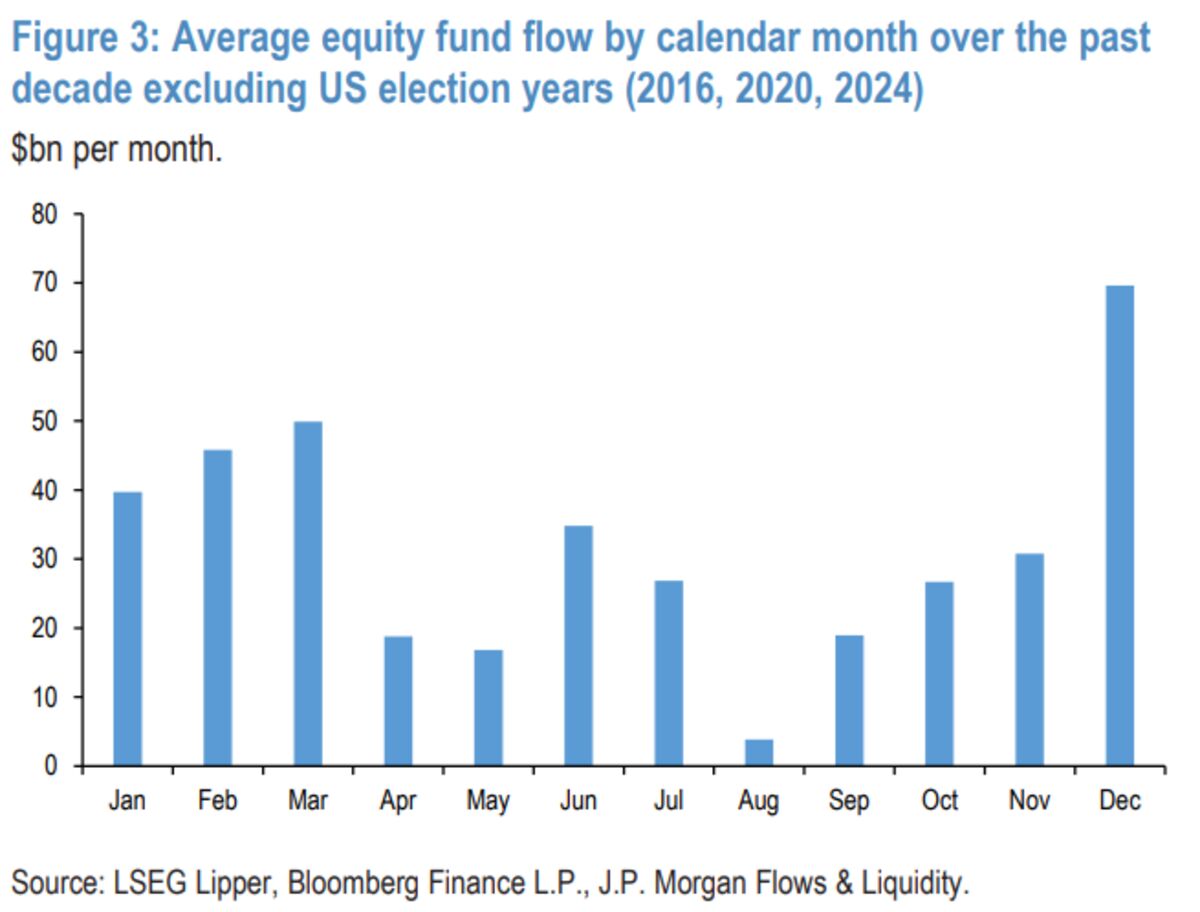

JPMorgan Chase & Co. has reported that strong inflows from retail investors are expected to provide significant support for stocks as we approach the end of the year. This trend is important because it indicates a growing confidence among individual investors, which could lead to a more robust market performance and potentially higher returns for those invested.

— via World Pulse Now AI Editorial System