Tricolor Not Indicative of Broader Issues: Goldman's Karouri

NeutralFinancial Markets

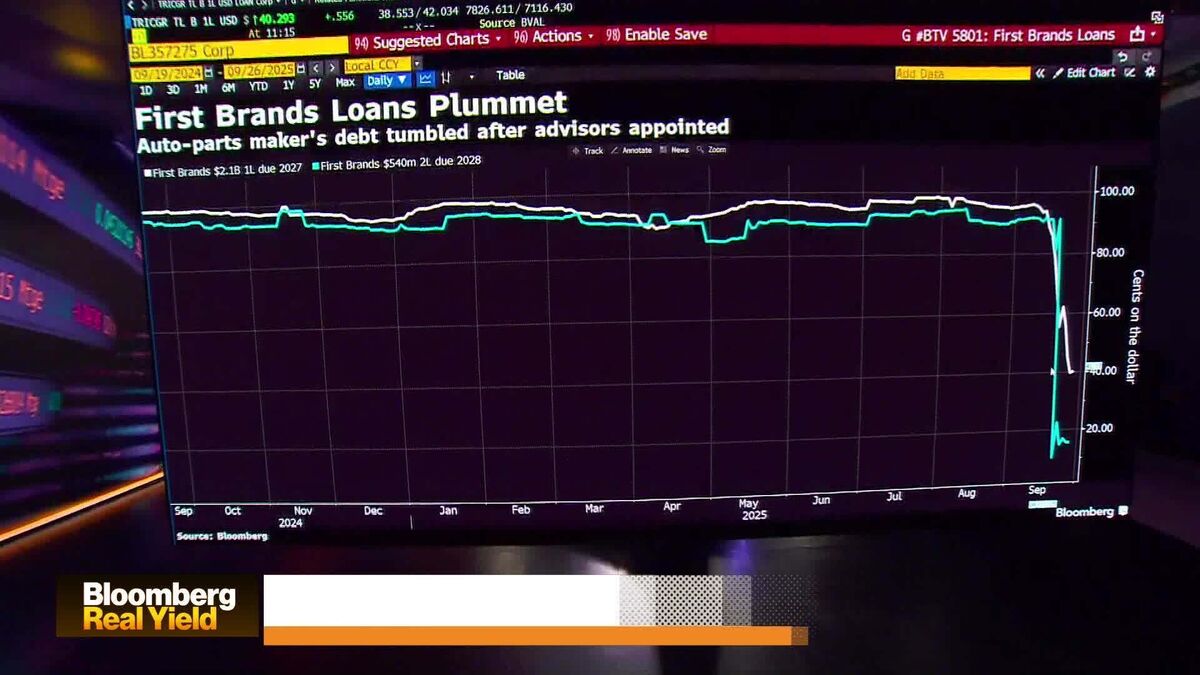

In a recent discussion on Bloomberg's 'Real Yield', Lotfi Karoui from Goldman Sachs and Sonali Pier from PIMCO addressed concerns in the credit market, particularly focusing on companies like Tricolor Holdings and First Brands that have faced financial challenges. Their insights are crucial as they highlight potential hotspots in the market, helping investors navigate through uncertain times.

— Curated by the World Pulse Now AI Editorial System