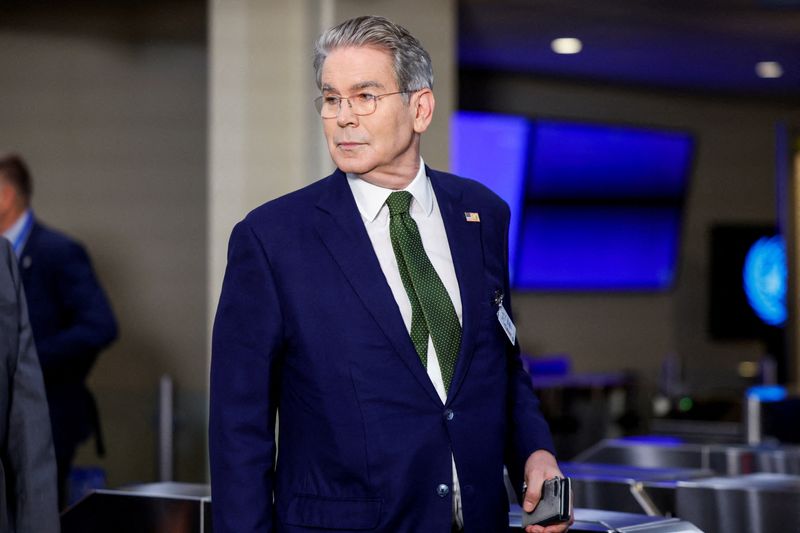

US is not putting money into Argentina, Bessent says

NegativeFinancial Markets

In a recent statement, Bessent highlighted that the US is currently not investing in Argentina, raising concerns about the country's economic future. This lack of financial support could hinder Argentina's recovery efforts and exacerbate existing economic challenges, making it a critical issue for both local citizens and international observers.

— Curated by the World Pulse Now AI Editorial System