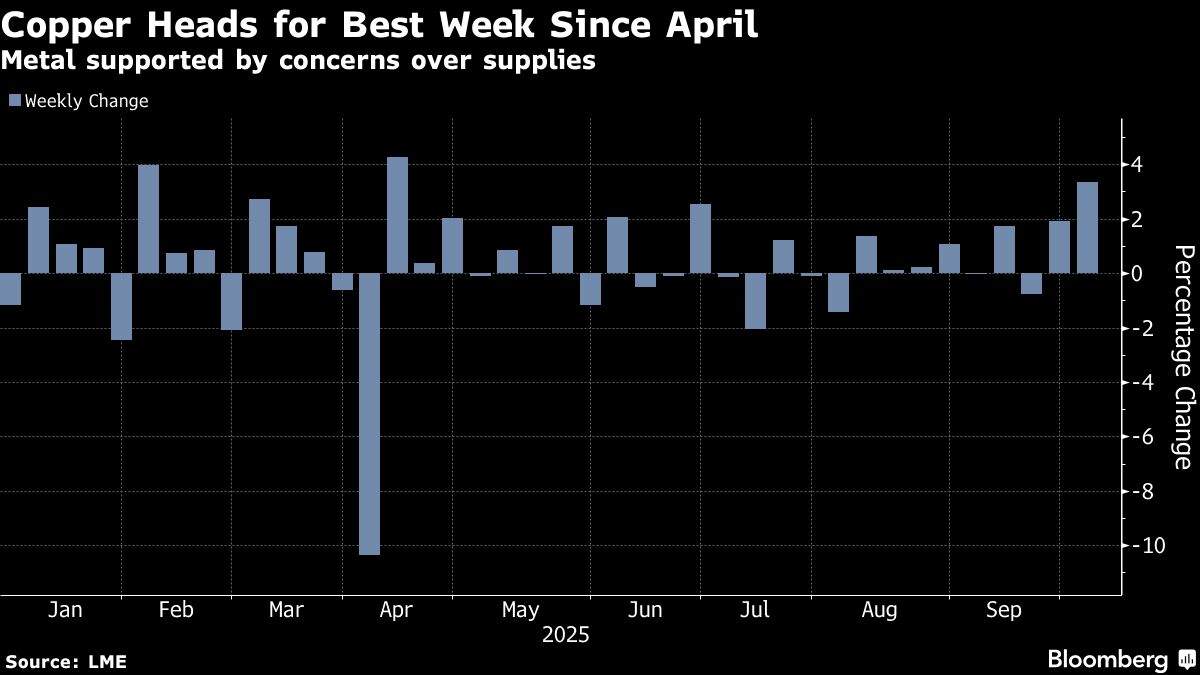

Copper Rally Gathers Steam on Supply Concerns and Weaker Dollar

PositiveFinancial Markets

Copper prices are experiencing a significant rally, marking the largest weekly gain since April. This surge is driven by supply disruptions and a weaker US dollar, alongside growing optimism about demand. With prices now just 5% below last year's record, this trend is crucial as it reflects broader economic conditions and could impact various industries reliant on copper.

— via World Pulse Now AI Editorial System