Commodity Vessels Clog Up China Ports as Fees on US Ships Begin

NegativeFinancial Markets

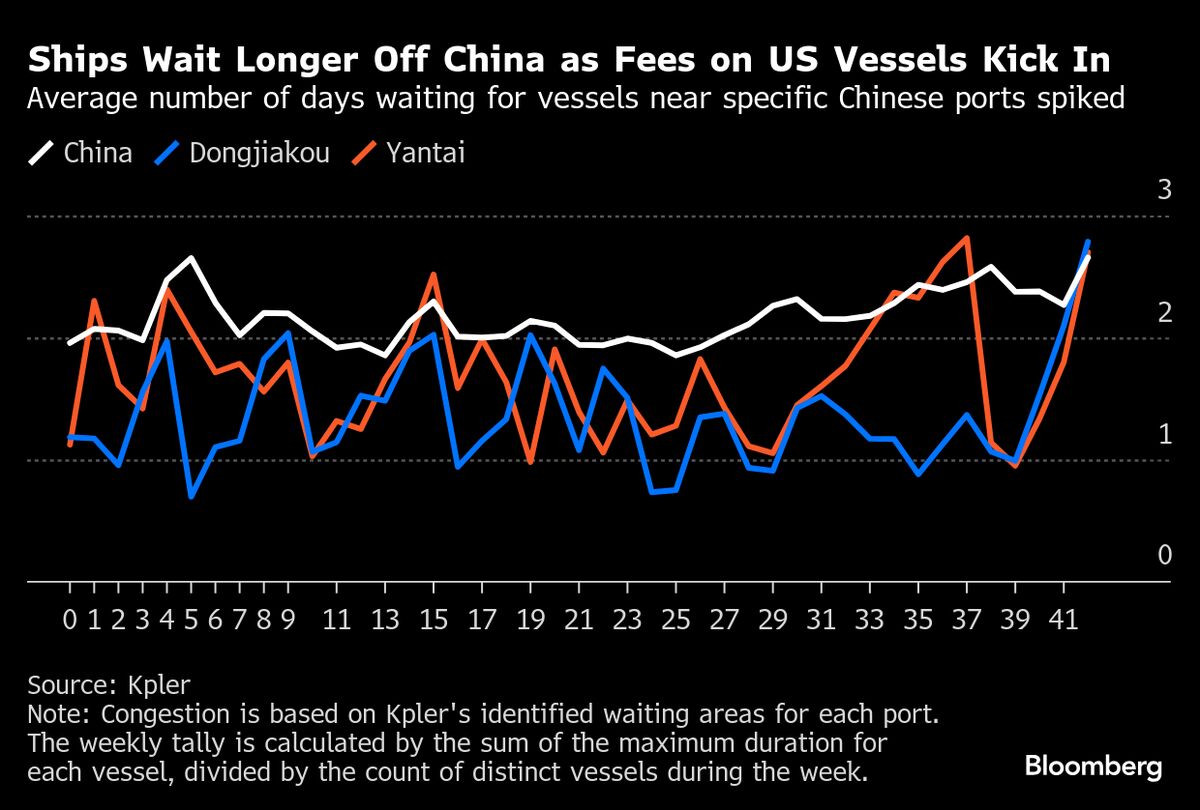

Waiting times for commodity vessels at China's ports have reached their longest this year, highlighting the impact of escalating tensions between Beijing and Washington on global trade. This situation is significant as it not only affects shipping schedules but also has broader implications for international commerce and economic stability.

— Curated by the World Pulse Now AI Editorial System