Bitcoin Jumps Back Above $90,000 After Bruising Selloff

PositiveFinancial Markets

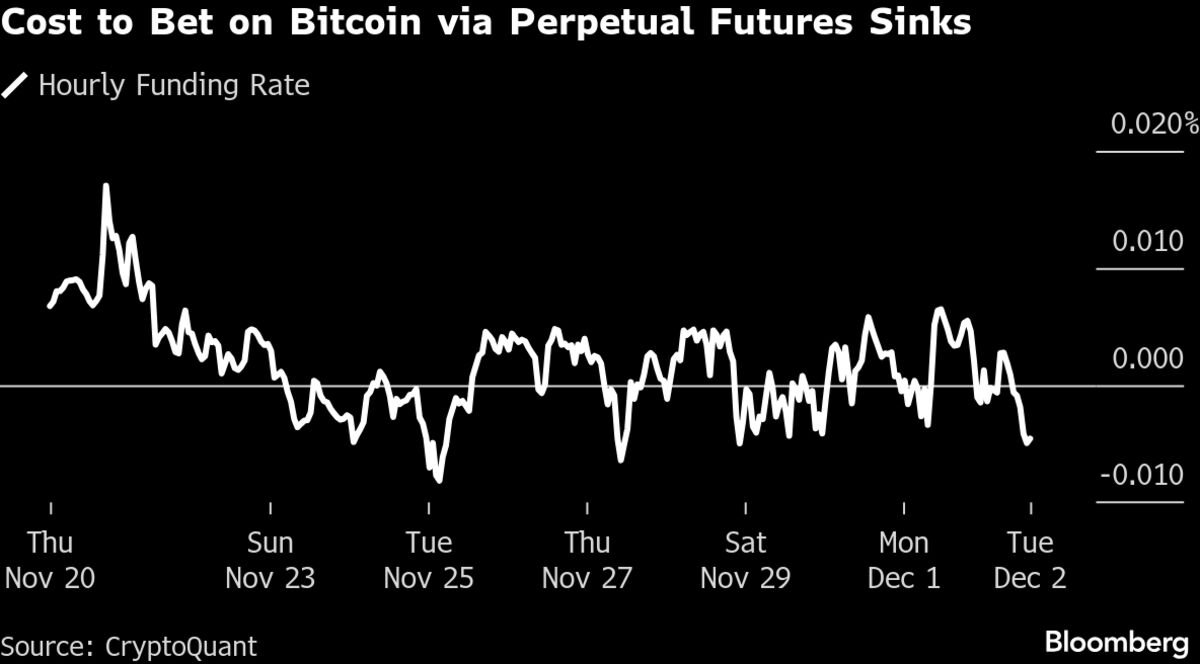

- Bitcoin surged back above $90,000 on Tuesday, recovering from a significant selloff that had erased nearly $1 billion in leveraged bets, catching Wall Street off guard. This rebound provided a temporary relief amid a prolonged downturn in the cryptocurrency market, although traders remain cautious due to ongoing market stress.

- The recovery of Bitcoin's value is crucial as it reflects a potential shift in trader sentiment and could restore some confidence in the cryptocurrency market, which has faced severe volatility and losses in recent months.

- This rebound occurs against a backdrop of fluctuating market conditions, where broader risk assets are also showing signs of recovery. Analysts are observing a cautious optimism in various markets, including predictions of rebounds in other sectors, indicating a complex interplay of investor sentiment and market dynamics.

— via World Pulse Now AI Editorial System