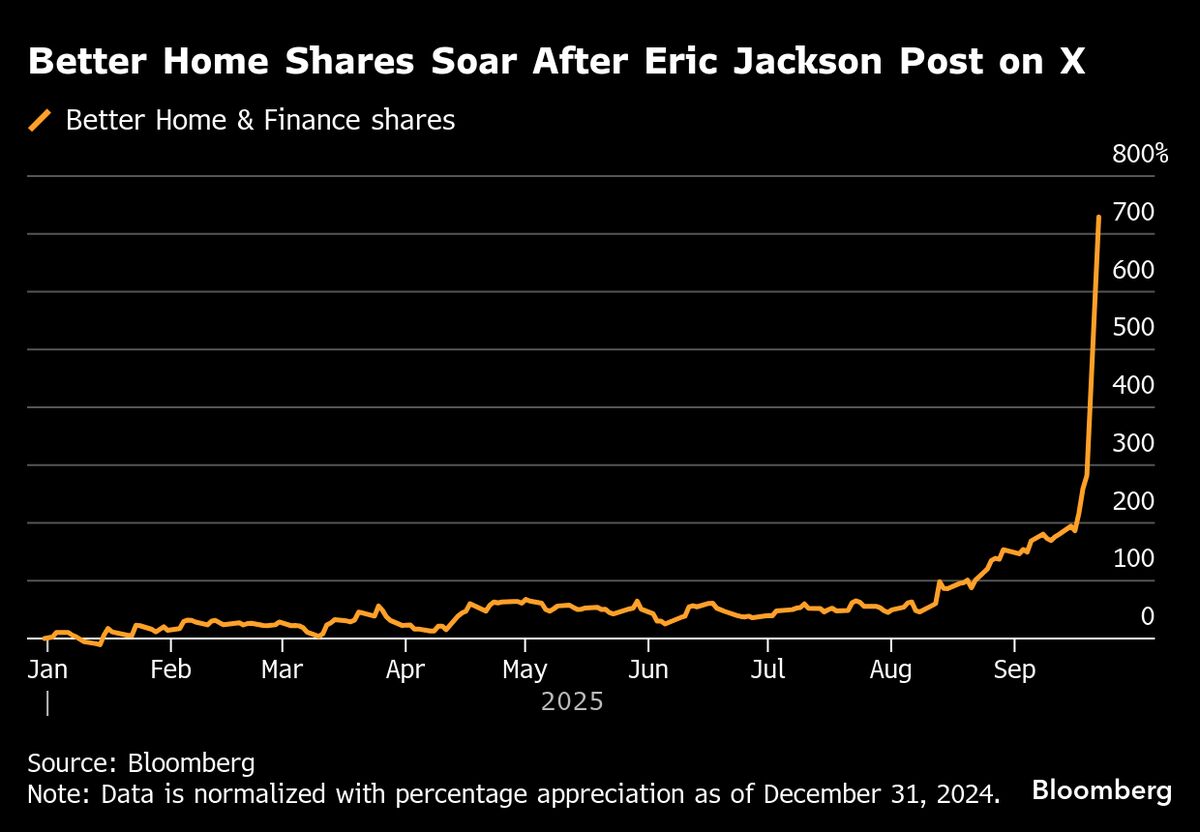

Better Home Surges as Man Behind Opendoor’s Meme Rally Goes Long

PositiveFinancial Markets

Shares of Better Home & Finance Holding Co. have seen a significant surge following Eric Jackson's announcement that his hedge fund is investing in the stock. This move mirrors the retail-driven rally he initiated with Opendoor Technologies Inc. back in July, highlighting the growing interest and confidence in Better Home's potential. This is important as it reflects a trend where retail investors are increasingly influencing stock prices, showcasing the power of collective investment strategies.

— Curated by the World Pulse Now AI Editorial System