US rate futures raise odds of further easing in October after Fed cut rates by 25 bps

PositiveFinancial Markets

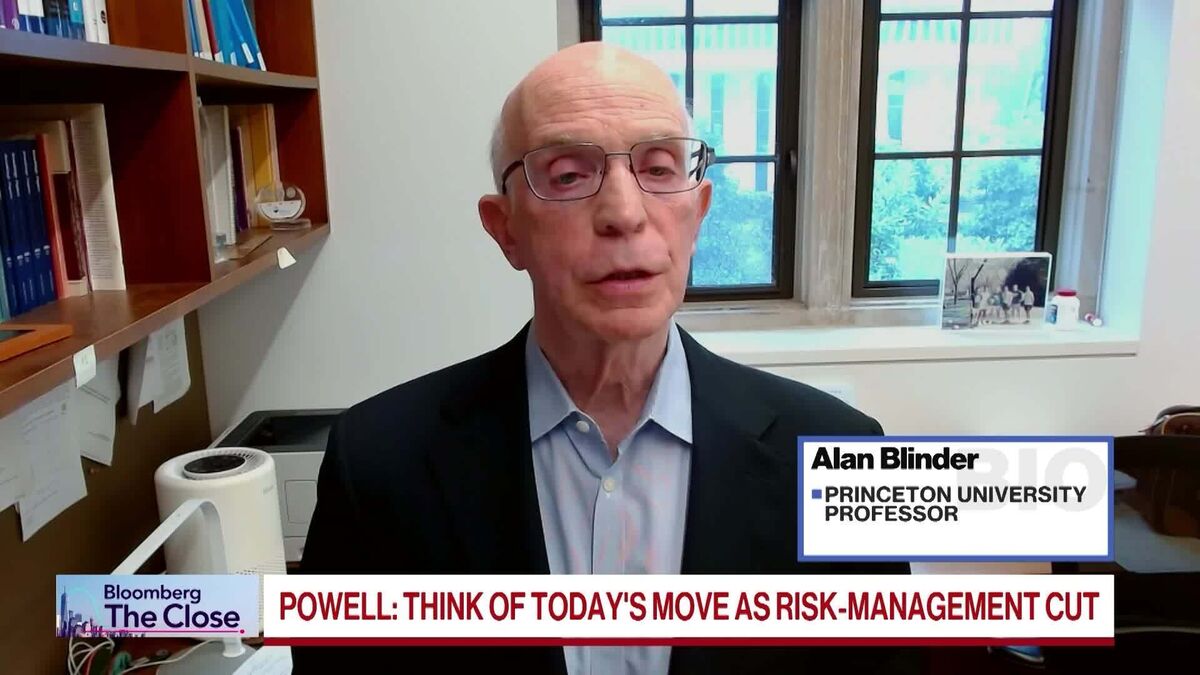

The recent decision by the Federal Reserve to cut interest rates by 25 basis points has sparked optimism in the markets, with futures indicating a higher likelihood of further easing in October. This move is significant as it aims to stimulate economic growth and support investors, especially in a time of uncertainty. The potential for additional rate cuts could provide much-needed relief to borrowers and boost consumer spending, which is crucial for the overall economy.

— Curated by the World Pulse Now AI Editorial System