Currency Arbitrage Costs Milei $2 Billion a Month in Argentina

NegativeFinancial Markets

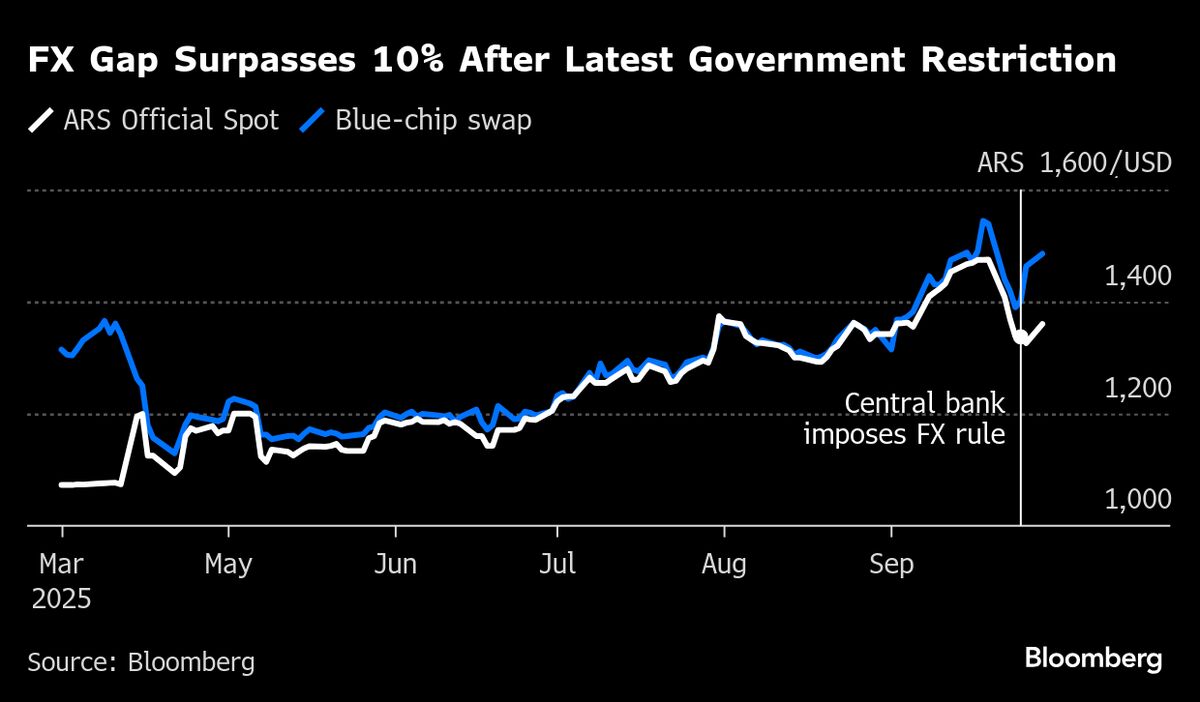

Argentina is facing a significant economic challenge as President Javier Milei's government struggles to rebuild its reserves. A recent surge in farm-export dollars has led many Argentines to buy cheap U.S. dollars, costing the country an estimated $2 billion a month. This situation highlights the ongoing difficulties in stabilizing the economy and the impact of currency arbitrage on national finances.

— Curated by the World Pulse Now AI Editorial System