Trump Terminates Canada Trade Talks; Intel Rallies on Upbeat Forecast | Bloomberg Brief 10/24/2025

NegativeFinancial Markets

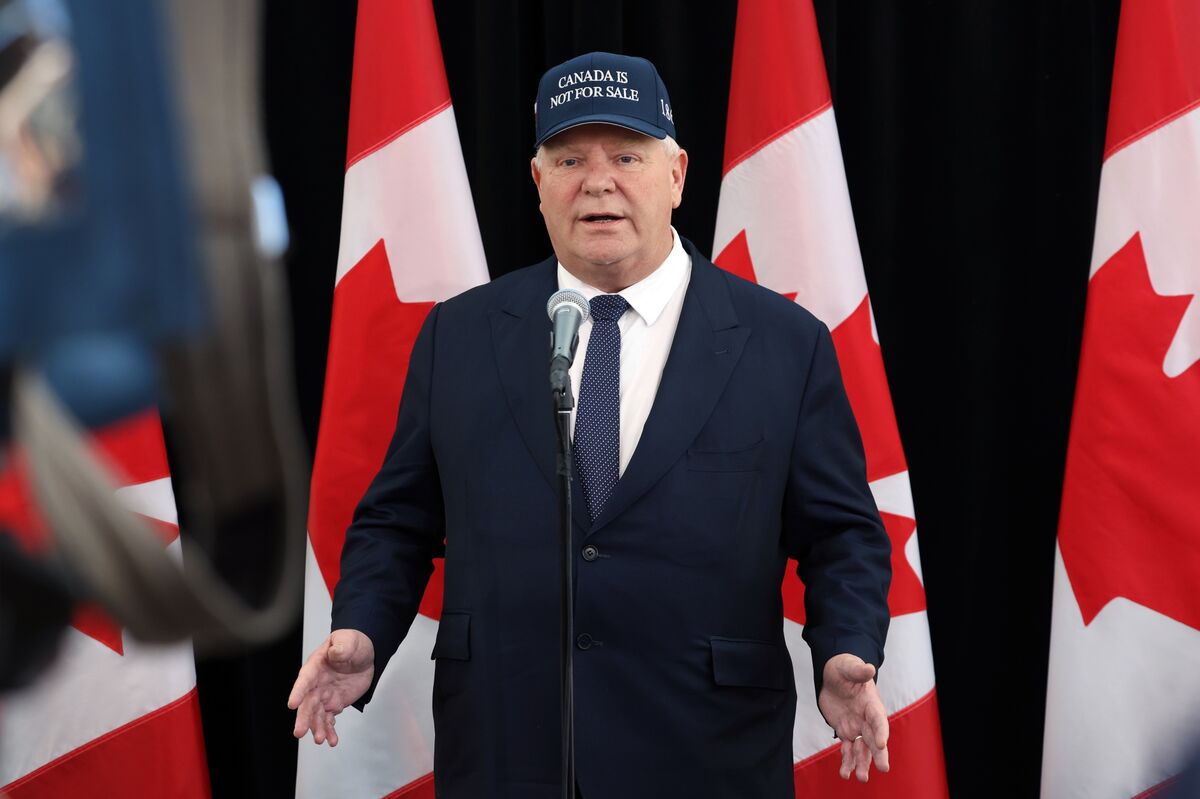

President Trump's decision to terminate trade talks with Canada over a controversial ad campaign has raised concerns in the market, especially as US equity futures rise ahead of the delayed CPI data. The ad, funded by Ontario, features excerpts from Ronald Reagan's speech, which has sparked a backlash. Meanwhile, Intel's shares are climbing after the company reported a return to profitability and provided an optimistic forecast. This situation highlights the delicate balance of international trade relations and its impact on the economy.

— Curated by the World Pulse Now AI Editorial System