Energy & Utilities Roundup: Market Talk

NeutralFinancial Markets

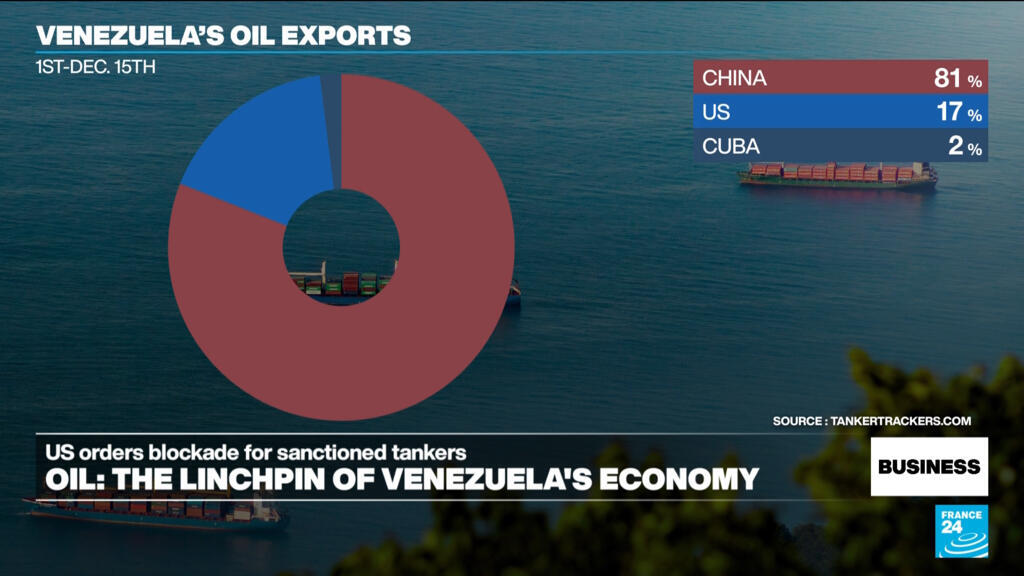

- Recent Market Talks from The Wall Street Journal have provided insights into oil futures and the implications of the U.S. blockade on oil tankers in and out of Venezuela, highlighting the ongoing challenges in the energy sector. This analysis is crucial for understanding current market dynamics affecting pricing and investment strategies.

- The developments in oil futures and the blockade of Venezuelan oil are significant for investors and industry professionals, as they directly impact supply chains and market stability. Understanding these factors is essential for making informed investment decisions in the energy sector.

- The situation reflects broader themes in the energy market, including geopolitical tensions, fluctuating oil prices, and the ongoing transition towards renewable energy sources. Stakeholders are closely monitoring these trends as they navigate the complexities of energy pricing and supply dynamics.

— via World Pulse Now AI Editorial System