A Trader’s Guide to China’s Biggest Political Meeting of 2025

PositiveFinancial Markets

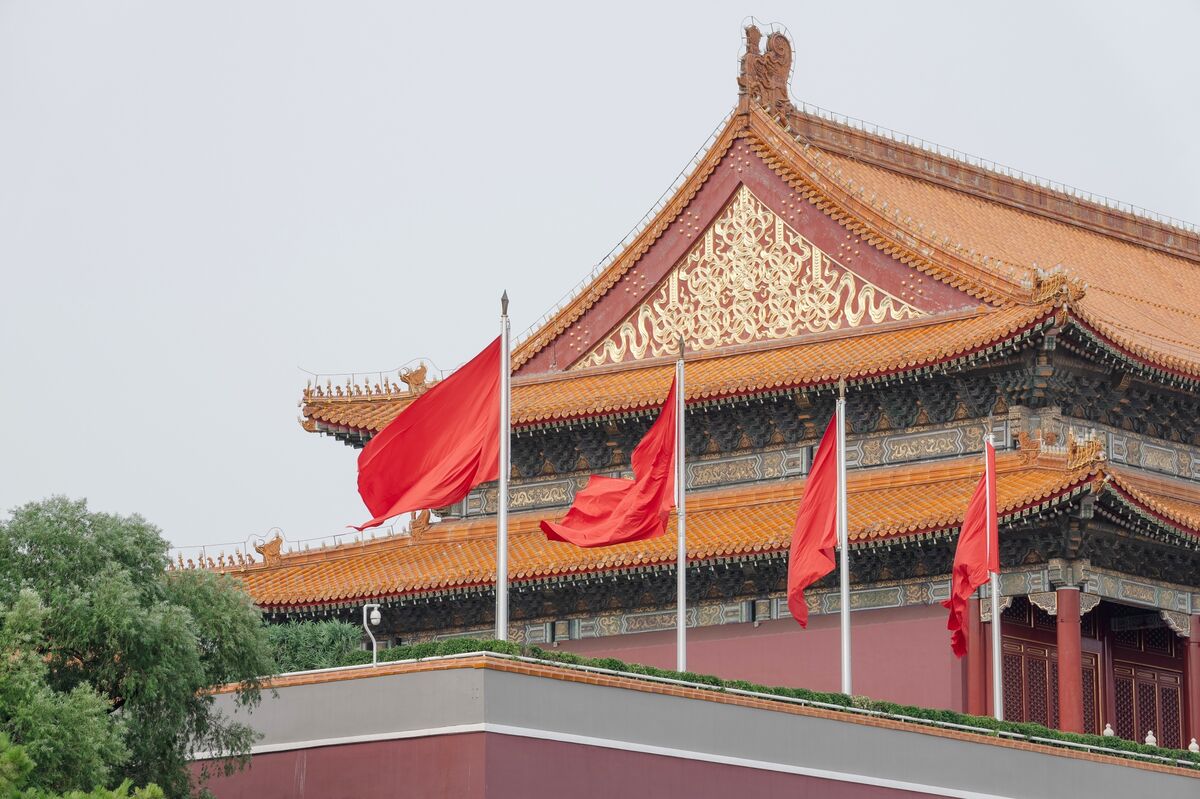

This week, a significant political meeting in Beijing is set to potentially introduce new policies that could bolster China's strongest equity rally in eight years and stabilize the yuan. As investors navigate the complexities of rising trade tensions with the US, the outcomes of this gathering could have far-reaching implications for the market and the economy, making it a crucial event to watch.

— Curated by the World Pulse Now AI Editorial System