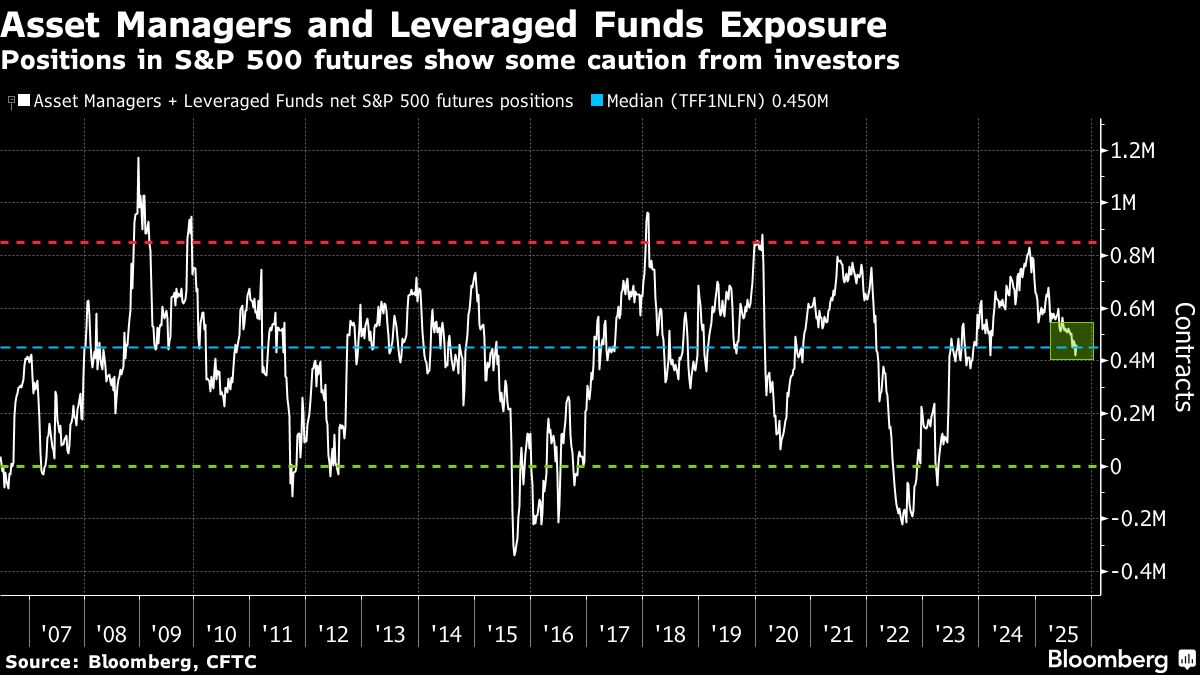

JPMorgan Strategists Say Hedge Funds Cautious on Equity Exposure

NeutralFinancial Markets

JPMorgan strategists have noted that despite global stocks reaching record highs, hedge funds are exhibiting caution in their equity exposure. This hesitance among investors highlights a potential divergence in market sentiment, as some are wary of the sustainability of these gains. Understanding this cautious approach is crucial for market watchers, as it may indicate underlying concerns about future market volatility.

— via World Pulse Now AI Editorial System