Brent Oil Breaks Above $70 as Pressure on Russia Intensifies

PositiveFinancial Markets

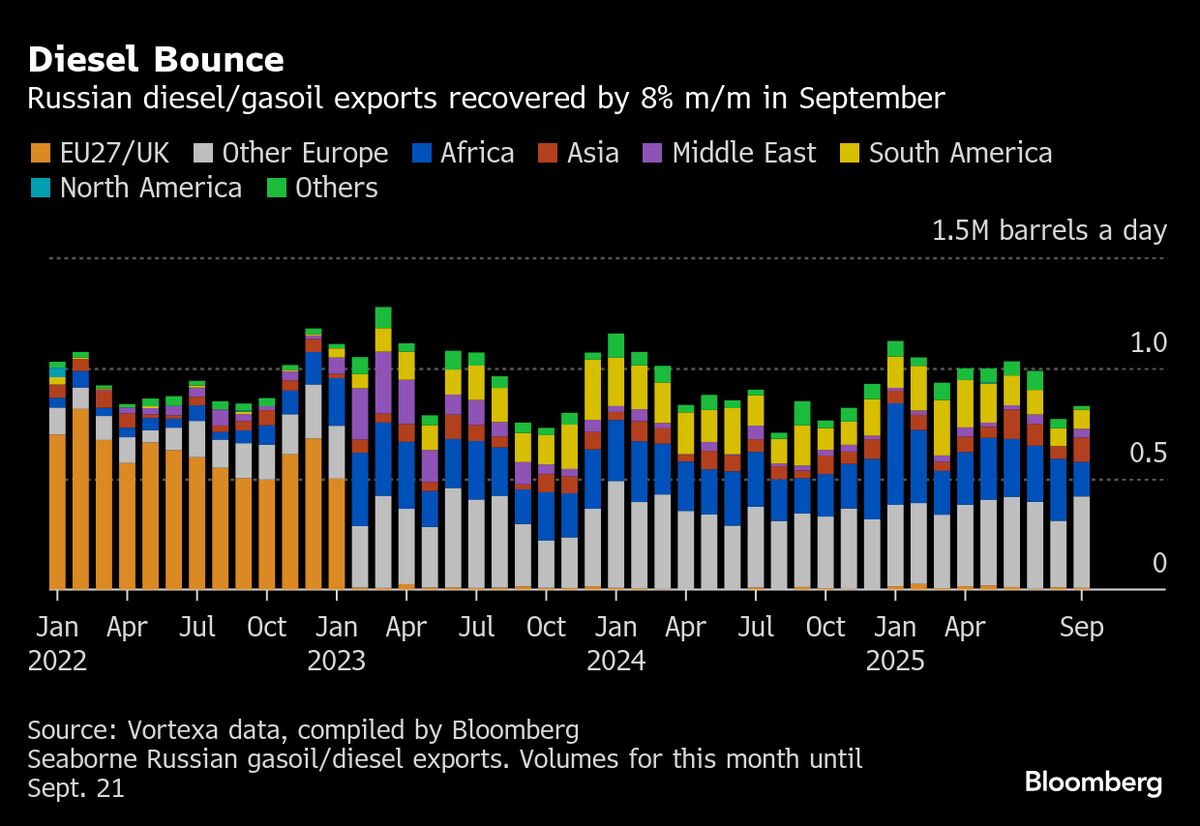

Brent oil prices have surged above $70, marking the largest weekly gain in over three months. This rise is largely driven by increasing pressure on Russia to conclude its ongoing conflict in Ukraine, which has created uncertainty around its oil exports. The involvement of algorithmic traders has further fueled this upward momentum, highlighting the dynamic nature of the oil market and its sensitivity to geopolitical events.

— Curated by the World Pulse Now AI Editorial System