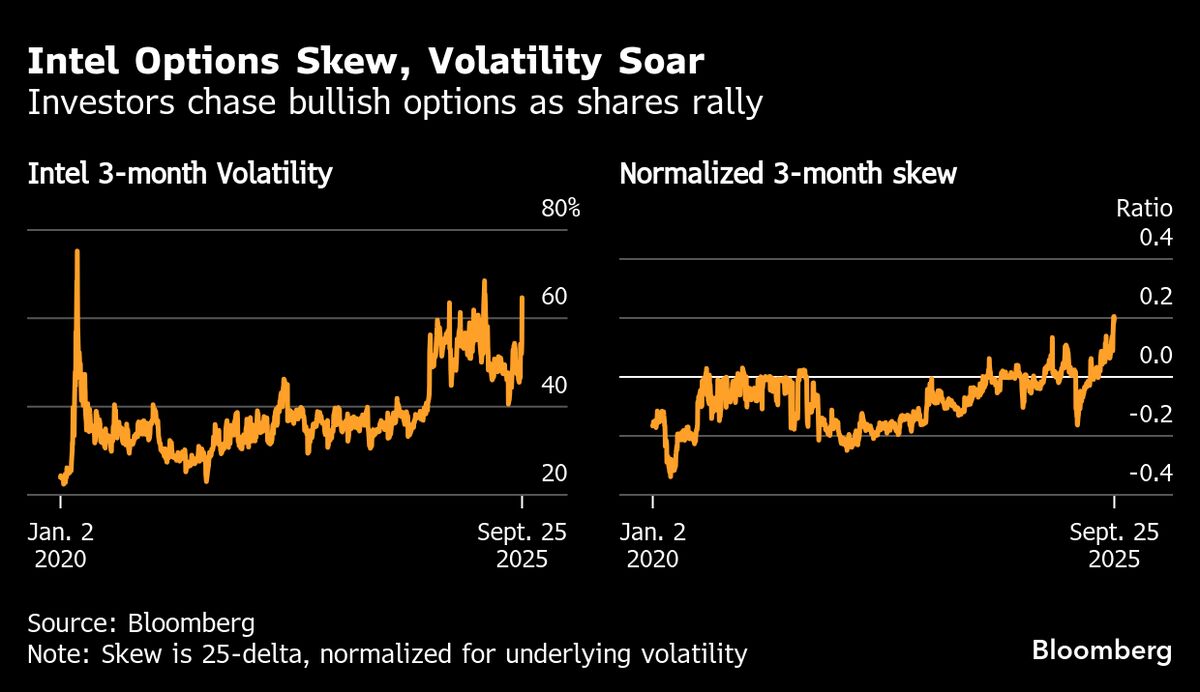

Intel Investors Snap Up Bullish Options to Chase Furious Rally

PositiveFinancial Markets

Investors are showing strong confidence in Intel Corp. by buying bullish options, driven by a recent rally fueled by significant investments from the US government and Nvidia Corp. This surge in interest suggests that many believe Intel's growth trajectory will continue, especially as the company explores new partnerships. Such optimism not only reflects the market's faith in Intel's potential but also highlights the broader trend of increasing investments in the tech sector.

— Curated by the World Pulse Now AI Editorial System