Aluminum Holds Near Highest in a Year in China on Tight Supply

PositiveFinancial Markets

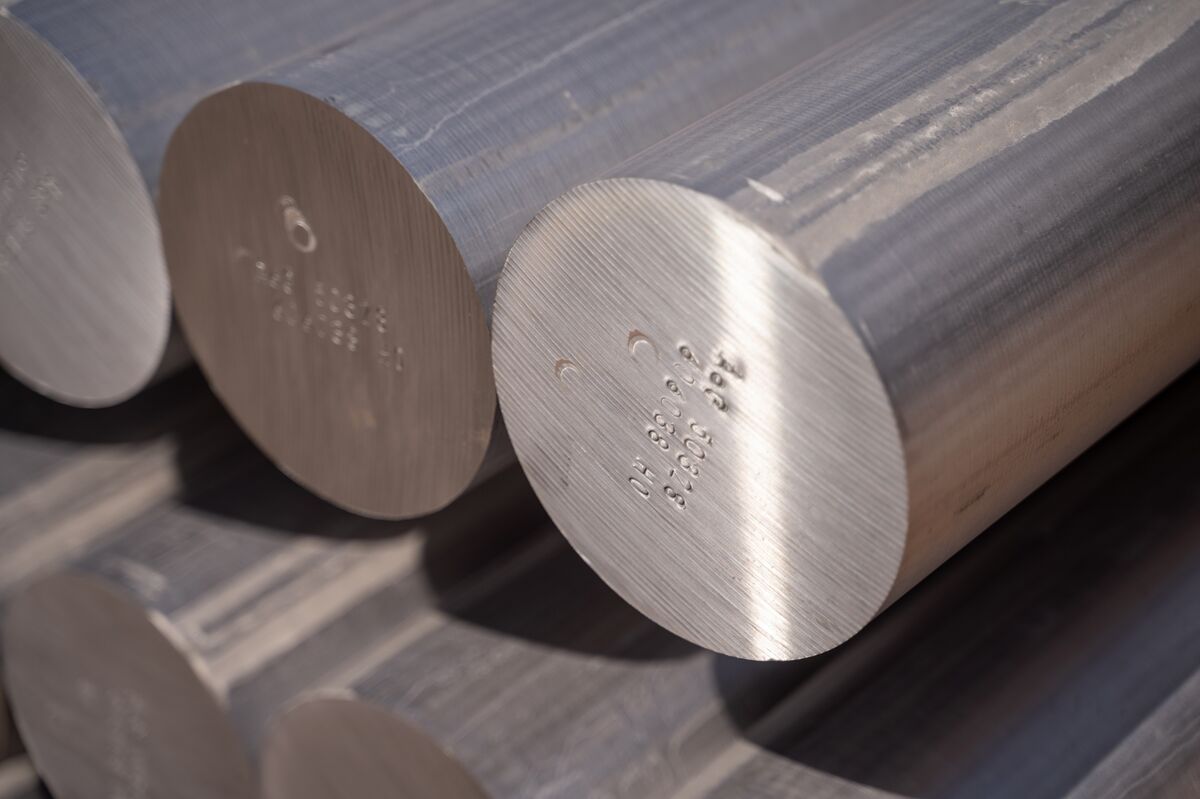

Aluminum Holds Near Highest in a Year in China on Tight Supply

Aluminum prices are holding steady near their highest levels in a year on the Shanghai Futures Exchange, driven by concerns over tightening supply. This is significant as it reflects the ongoing demand for aluminum in various industries, suggesting a robust market outlook and potential investment opportunities.

— via World Pulse Now AI Editorial System