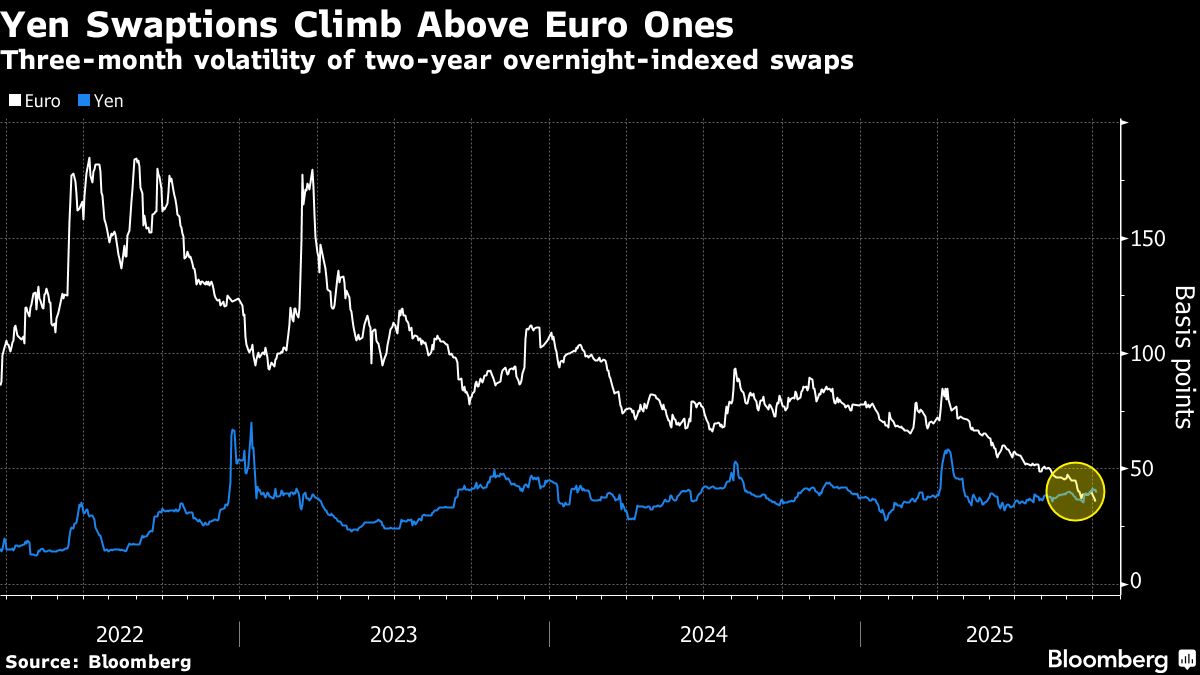

Japanese Rate Volatility Rises Above Europe’s on BOJ Uncertainty

NegativeFinancial Markets

The recent rise in volatility for yen interest rates, surpassing that of euro rates for the first time in seven years, highlights increasing uncertainty surrounding the Bank of Japan's monetary policy. This shift is significant as it reflects broader concerns about economic stability and could impact global markets, making it crucial for investors and policymakers to pay attention to Japan's financial strategies.

— Curated by the World Pulse Now AI Editorial System