Asia to Join Global Equity Rally Ahead of US CPI: Markets Wrap

PositiveFinancial Markets

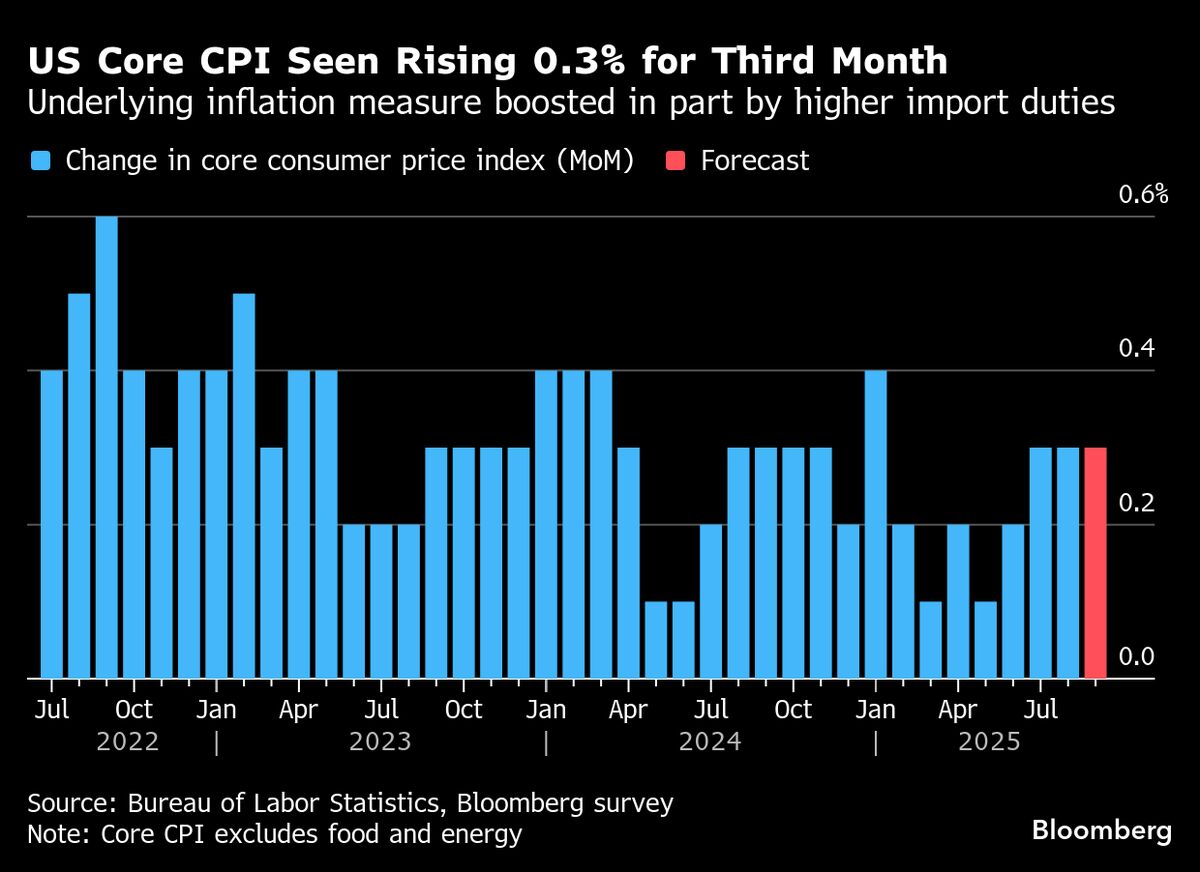

Asian stocks are poised for a positive opening as investor sentiment improves, driven by easing tensions between Washington and Beijing. This shift is significant as it reflects a broader global equity rally, with markets reacting favorably ahead of the upcoming US inflation data. The rise in oil prices and the decline in treasuries further indicate a dynamic market environment, making it an important moment for investors to watch.

— Curated by the World Pulse Now AI Editorial System