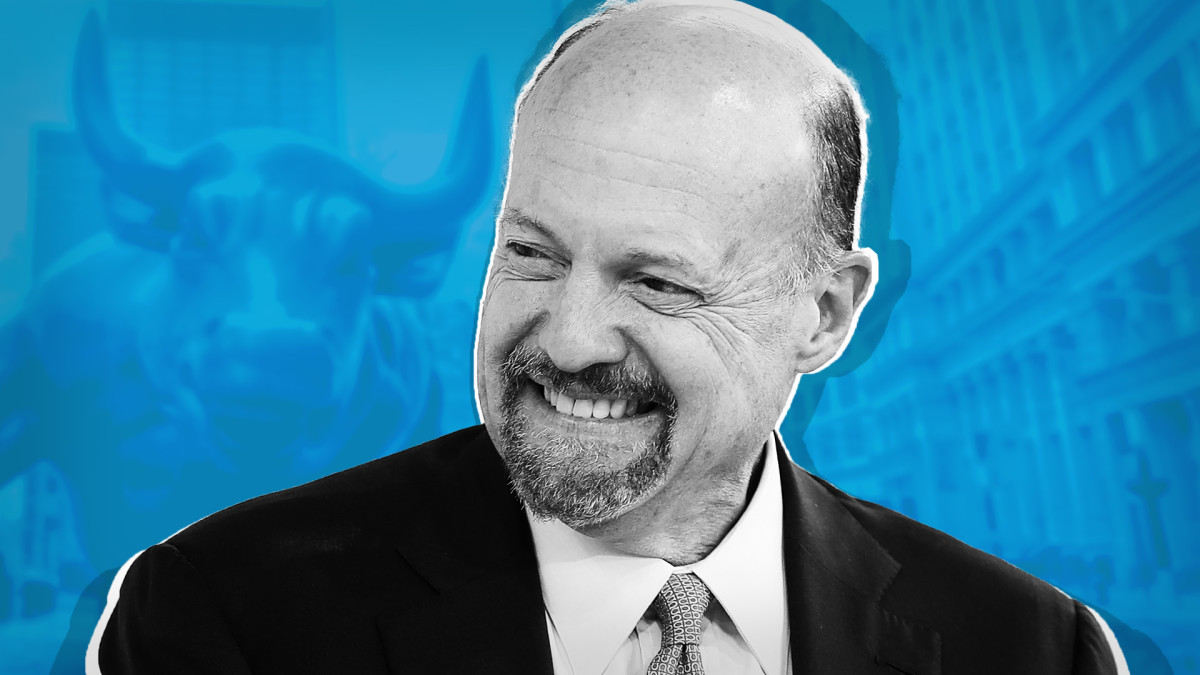

Jim Cramer resets AI stock ‘buy’ list for rest of 2025

PositiveFinancial Markets

Jim Cramer resets AI stock ‘buy’ list for rest of 2025

Jim Cramer, the host of CNBC's 'Mad Money', has updated his AI stock buy list for 2025, focusing on disciplined investments rather than speculative hype. This approach is significant as it guides investors towards more stable options in a market filled with flashy but unreliable startups. Cramer's insights could help investors make informed decisions, potentially leading to better returns in the evolving AI sector.

— via World Pulse Now AI Editorial System