Stocks, Gold Sink as Momentum Fades | The Close 10/22/2025

NegativeFinancial Markets

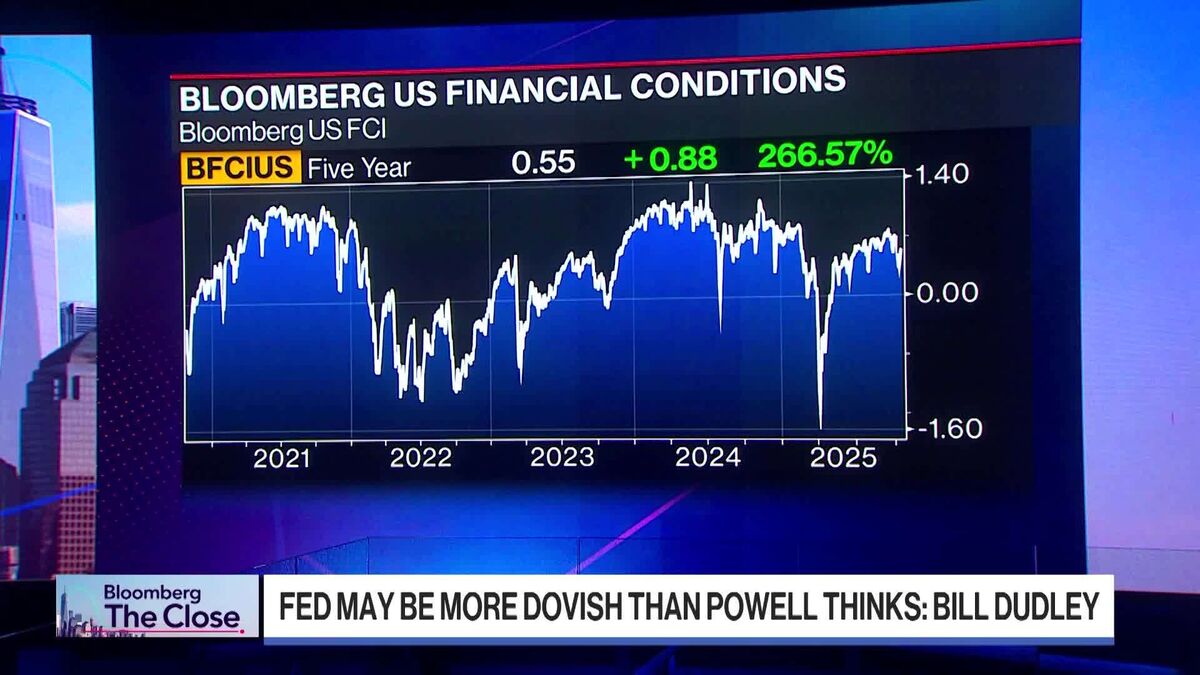

In a significant downturn, stocks and gold prices have dropped as market momentum wanes, highlighting concerns among investors. This decline is crucial as it reflects broader economic uncertainties and could influence investment strategies moving forward. With insights from notable financial experts, the discussion sheds light on the factors driving this trend and its potential implications for the market.

— Curated by the World Pulse Now AI Editorial System