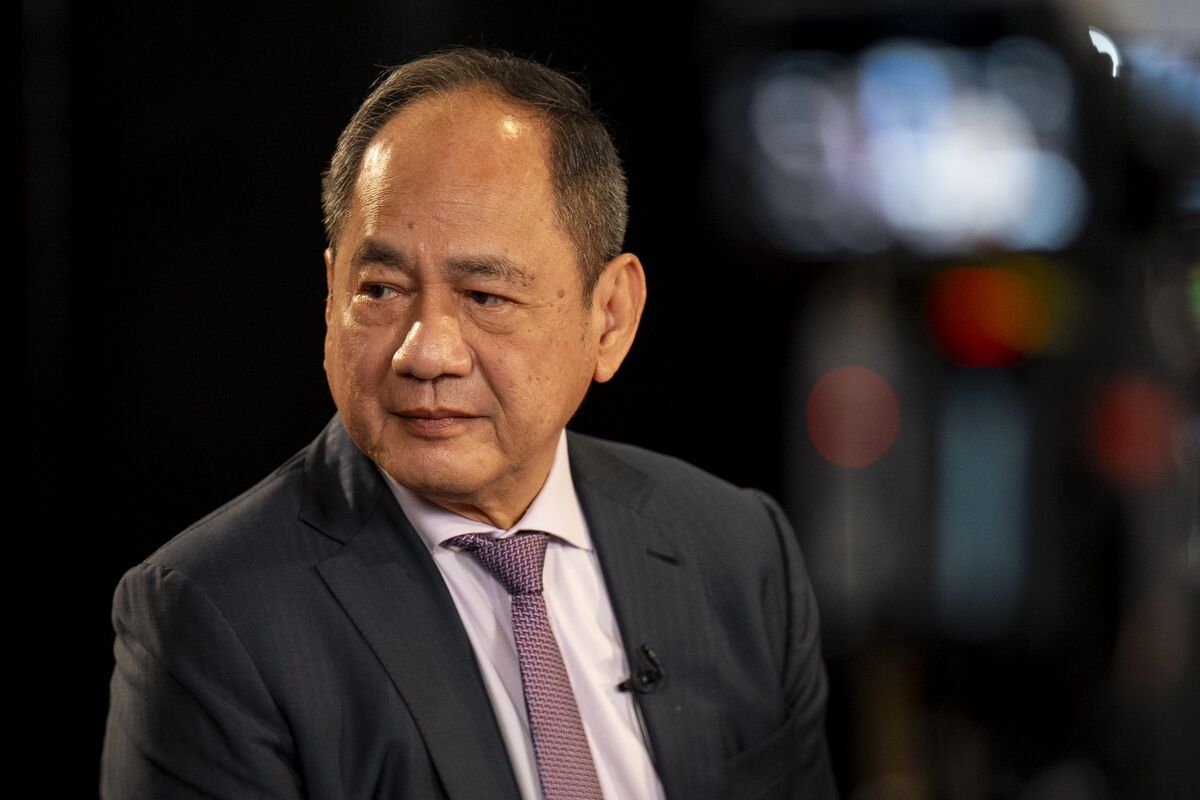

PSE CEO Says Graft Scandal May Weigh on Stocks Further

NegativeFinancial Markets

Philippine Stock Exchange President and CEO Ramon Monzon has expressed concerns that ongoing corruption allegations related to flood-control projects could further pressure the stock market. In an exclusive interview on 'Bloomberg: The China Show,' he highlighted the potential impact of these scandals on investor confidence and market stability, making it a critical issue for stakeholders in the financial sector.

— Curated by the World Pulse Now AI Editorial System