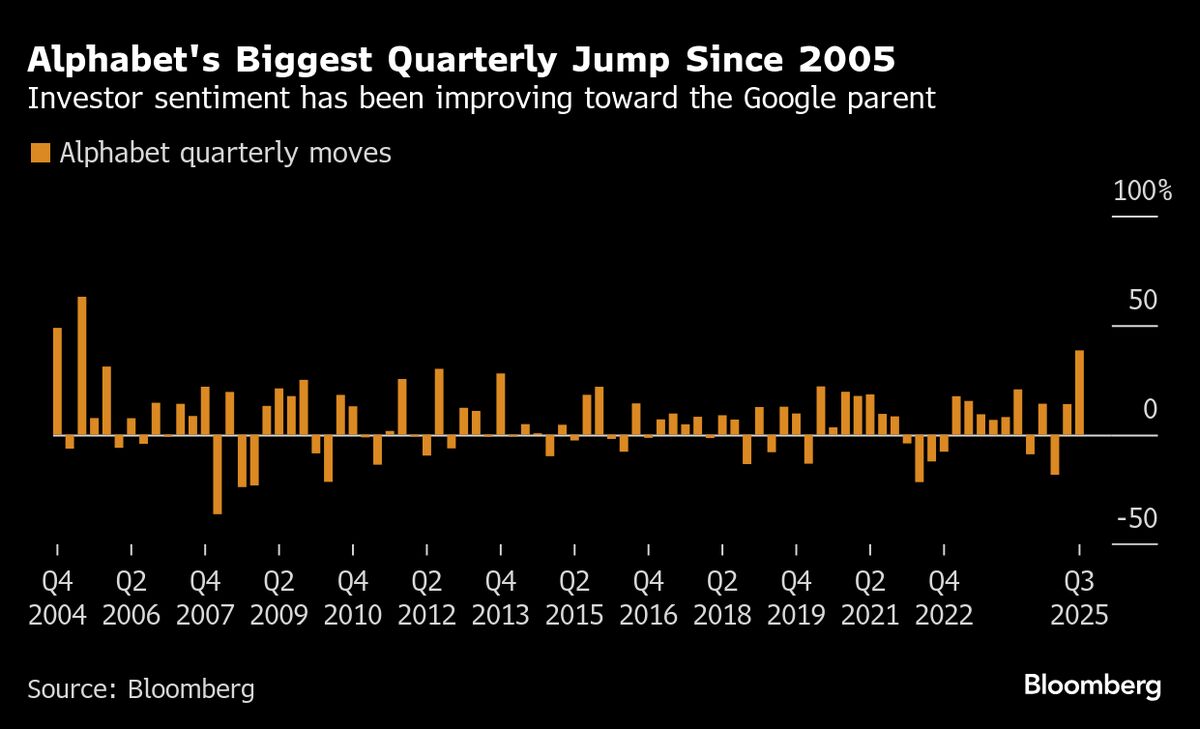

Alphabet’s AI Strength Fuels Biggest Quarterly Jump Since 2005

PositiveFinancial Markets

Alphabet Inc. is experiencing its largest quarterly gain in two decades, reflecting a growing investor confidence as the company enhances its position in artificial intelligence. This surge in stock value is significant as it indicates a shift in market sentiment towards tech companies that are innovating in AI, showcasing the potential for future growth and profitability.

— Curated by the World Pulse Now AI Editorial System