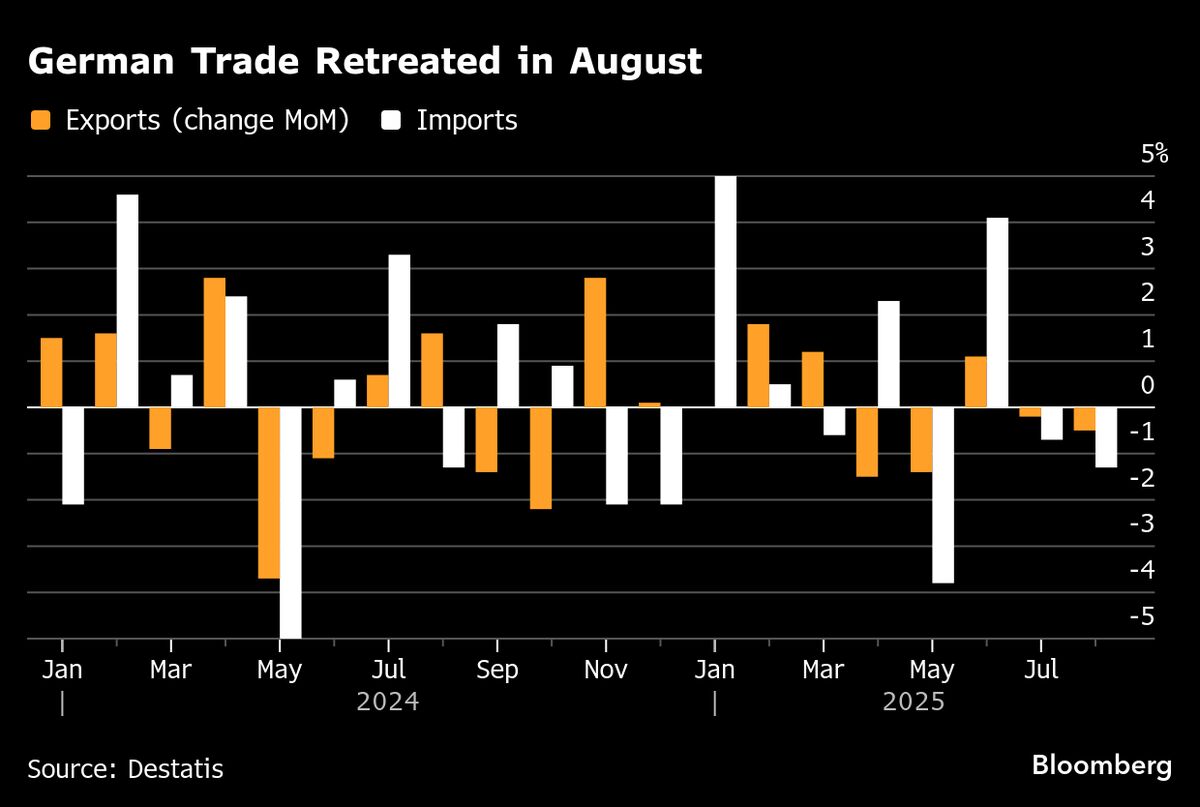

German Exports Unexpectedly Drop as Shipments to the US Sink

NegativeFinancial Markets

German exports have taken an unexpected hit, declining for the second consecutive month. This downturn is largely attributed to a significant drop in shipments to the US, which have reached their lowest point in nearly four years. The impact of President Donald Trump's tariff policies is evident, raising concerns about the future of trade relations and economic stability. This situation is crucial as it not only affects Germany's economy but also signals potential shifts in global trade dynamics.

— Curated by the World Pulse Now AI Editorial System