Ten Years After Paris, States Must Lead On EVs As Washington Retreats

NegativeFinancial Markets

- Global electric vehicle (EV) sales are experiencing significant growth, yet the United States risks falling behind as federal support diminishes. With Washington's retreat from proactive policies, states like California are urged to take the lead in promoting EV adoption to prevent ceding the market to competitors, particularly China.

- This situation is critical for the U.S. automotive industry, as the lack of federal backing could hinder innovation and investment in EV technology, leaving American manufacturers vulnerable to foreign competition, especially from China, which is advancing rapidly in the EV sector.

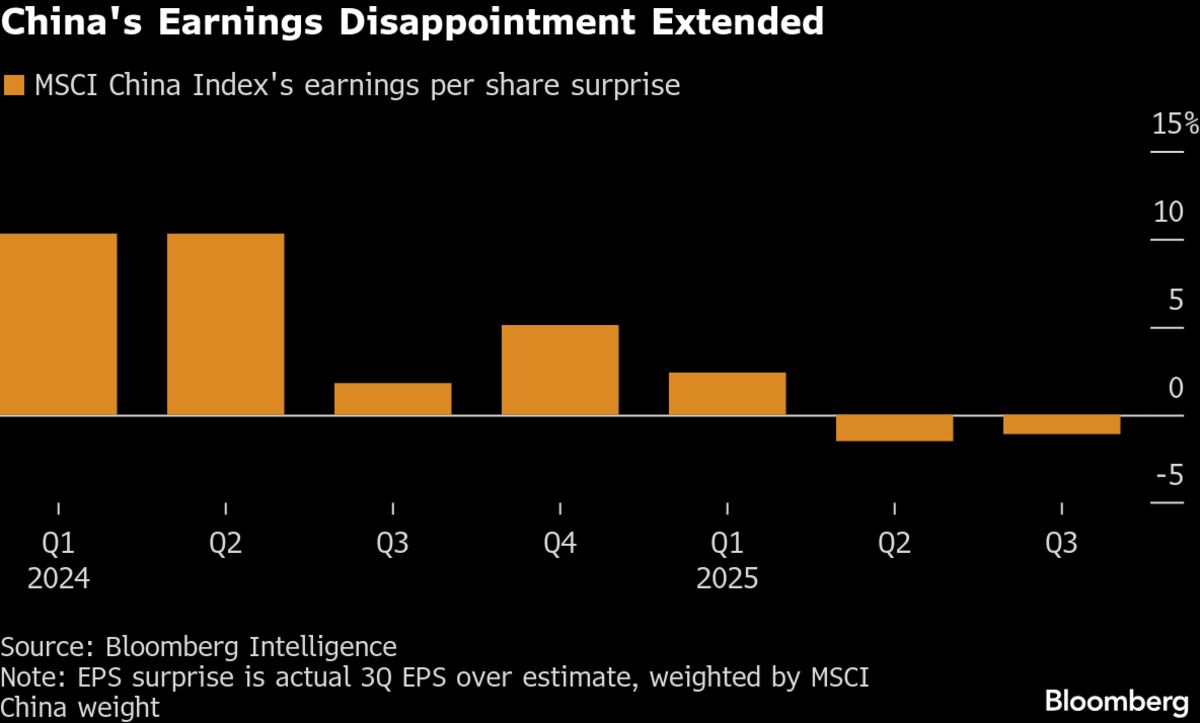

- The dynamics of the global EV market are shifting, with concerns arising over the sustainability of growth in China amidst disappointing earnings from local EV manufacturers. Meanwhile, European carmakers face challenges from Chinese automakers gaining traction in the plug-in hybrid market, highlighting a broader struggle for dominance in the transition to electric mobility.

— via World Pulse Now AI Editorial System