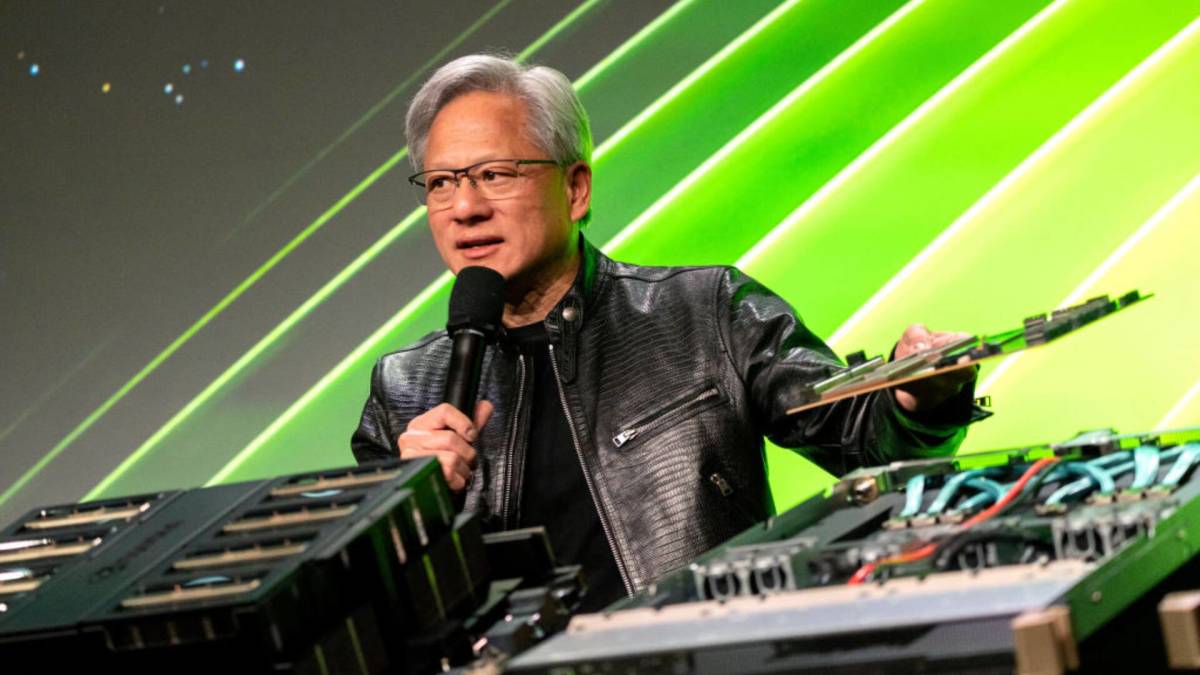

Nvidia to invest up to $1 billion in AI startup Poolside, Bloomberg News reports

PositiveFinancial Markets

Nvidia is set to invest up to $1 billion in the AI startup Poolside, according to Bloomberg News. This significant investment highlights Nvidia's commitment to advancing artificial intelligence technologies and supporting innovative startups in the field. By backing Poolside, Nvidia aims to enhance its portfolio and strengthen its position in the rapidly evolving AI landscape, which is crucial for future technological advancements.

— Curated by the World Pulse Now AI Editorial System