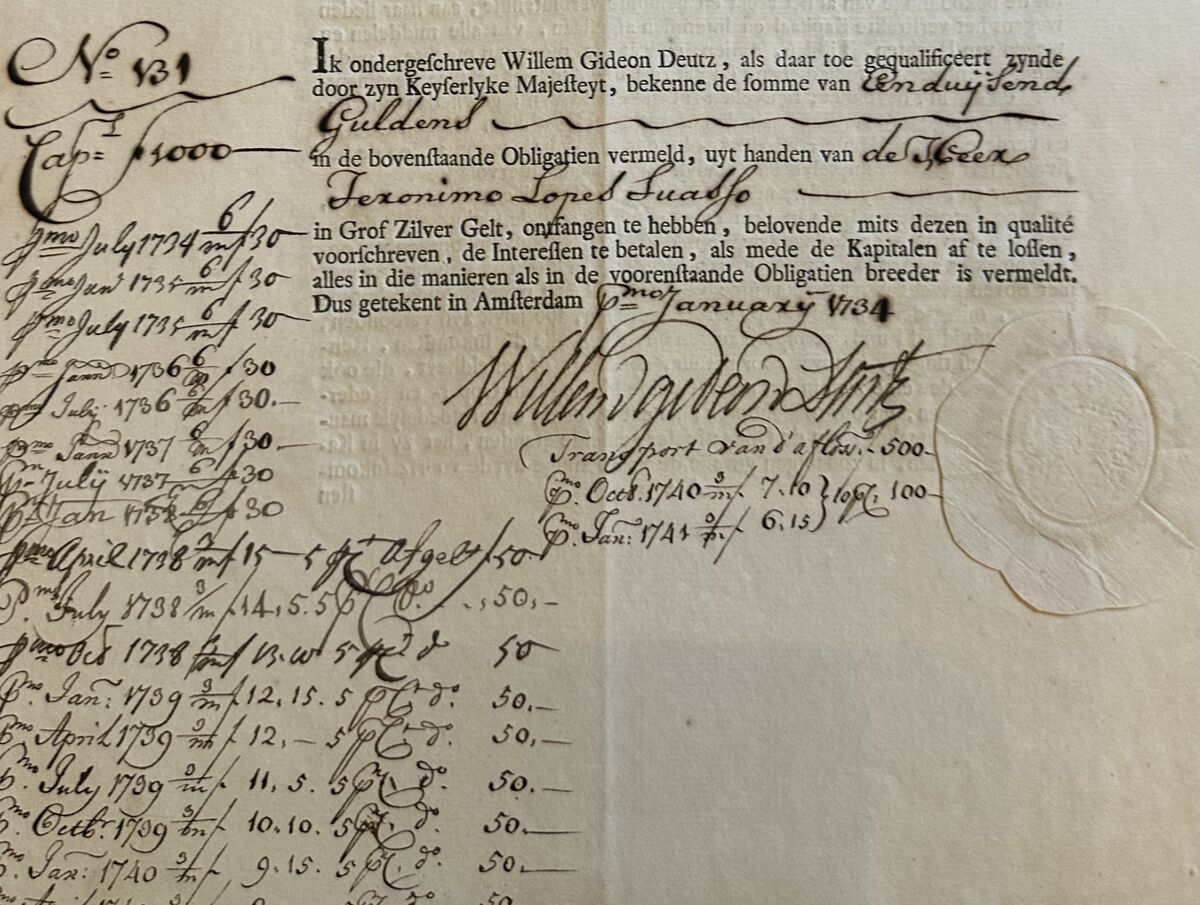

What a 1734 Silesian Bond Can Tell Us About the Future of Russia’s Frozen Assets

NeutralFinancial Markets

In this newsletter, Joe Weisenthal and Tracy Alloway explore the implications of a 1734 Silesian bond on the future of Russia's frozen assets. This topic is particularly relevant as it sheds light on historical financial instruments and their potential impact on current economic situations, especially in the context of international sanctions and asset management.

— Curated by the World Pulse Now AI Editorial System