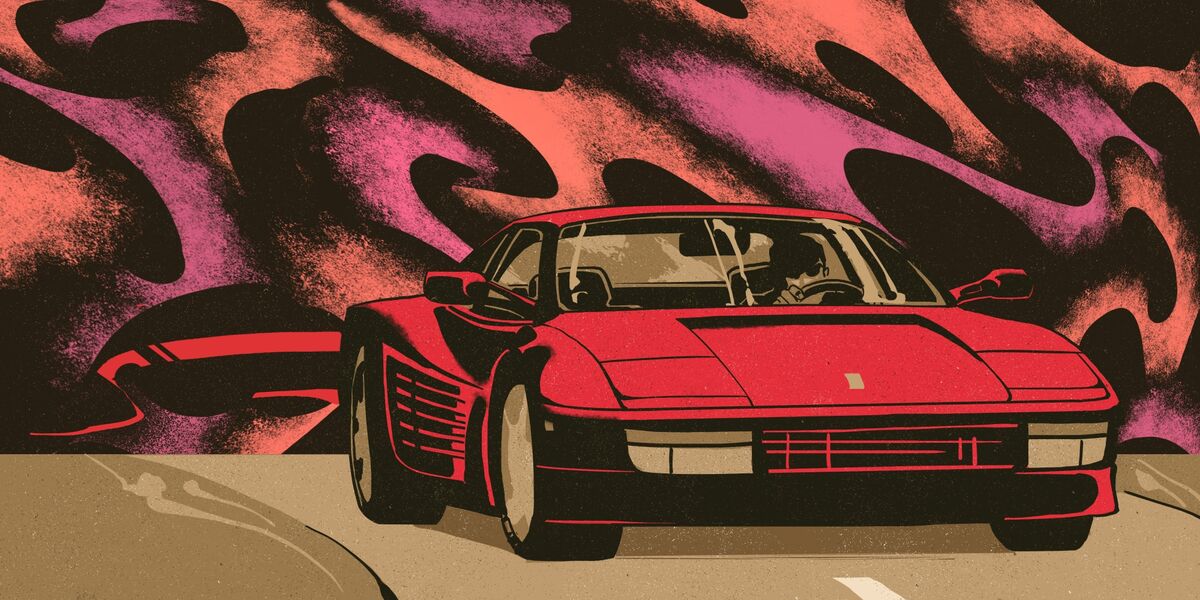

Ferrari-Loving Trader Burned Wall Street With Bond Bet Leveraged 11,000-to-1

NegativeFinancial Markets

A trader's risky bond bet, leveraged at an astonishing 11,000-to-1, has led to a staggering $2.6 billion loss for firms like Citigroup and MUFG. This incident is now central to a lawsuit in London, highlighting serious concerns about the adequacy of client checks in high-stakes trading. The fallout from this trade not only impacts the involved firms but also raises broader questions about risk management practices on Wall Street.

— Curated by the World Pulse Now AI Editorial System