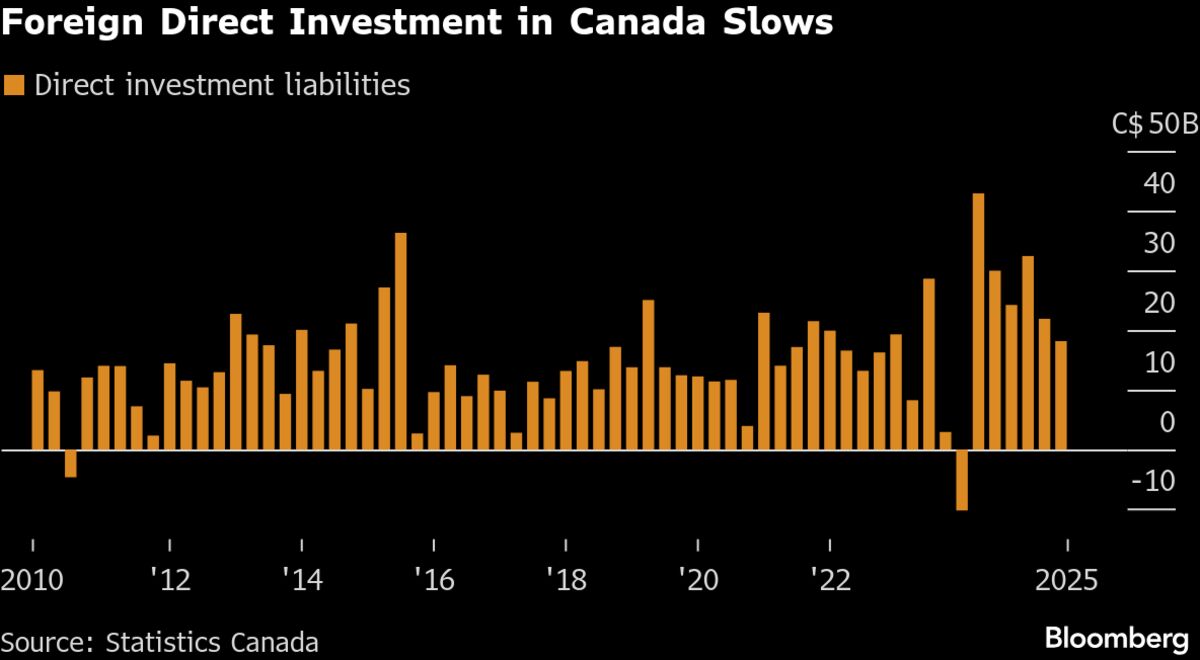

Foreign Investment in Canada Falls to Lowest Since Start of ‘24

NegativeFinancial Markets

- Foreign direct investment in Canada has declined in the third quarter, marking the lowest level in a year and a half, as reported by Bloomberg. This downturn reflects ongoing economic challenges and uncertainty in the investment climate.

- The drop in foreign investment is significant as it may hinder economic growth and development in Canada, impacting various sectors that rely on external funding and investment for expansion and innovation.

- This decline in investment coincides with a broader trend of economic difficulties, including a 0.7% decrease in retail sales in September and concerns over stock market performance, which have been influenced by rising interest rates and fears surrounding artificial intelligence.

— via World Pulse Now AI Editorial System