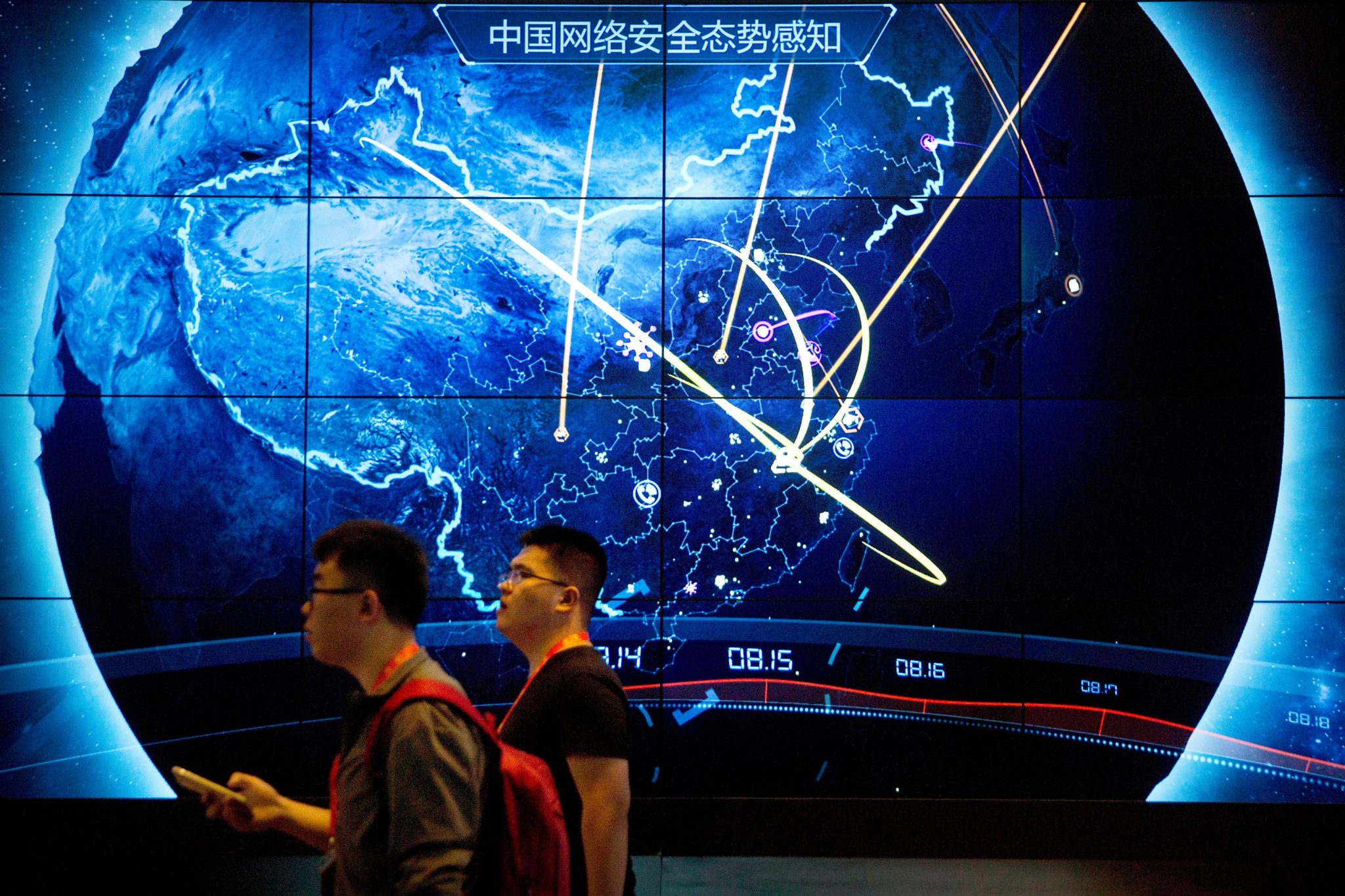

China accuses U.S. National Security Agency of using ‘special cyberattack weapons’ to target time center

NegativeFinancial Markets

China has accused the U.S. National Security Agency of employing specialized cyberattack weapons to target its time center, which is crucial for distributing the country's standard time and supporting various industries like communications and finance. This accusation highlights ongoing tensions between the two nations in the realm of cybersecurity and raises concerns about the security of critical infrastructure.

— Curated by the World Pulse Now AI Editorial System