US treasury chief says he will be present at Supreme Court hearing on tariffs

NeutralFinancial Markets

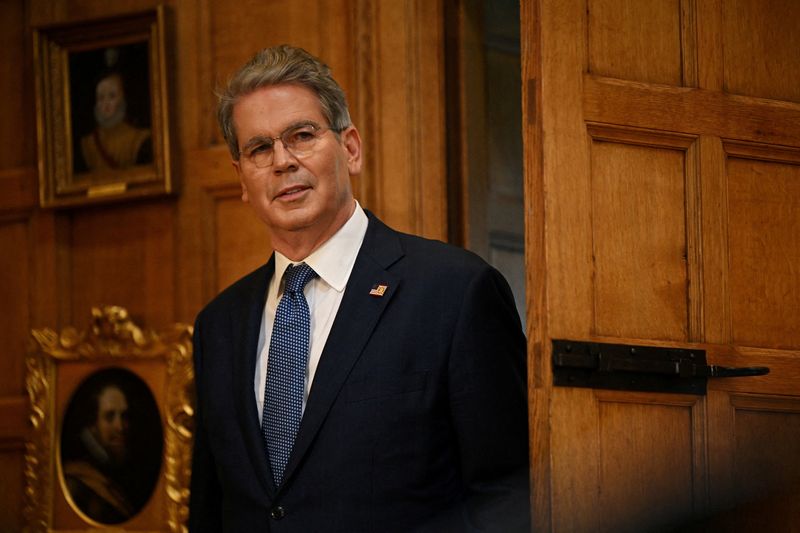

The US Treasury Secretary has announced his attendance at an upcoming Supreme Court hearing regarding tariffs. This event is significant as it highlights the government's ongoing efforts to address trade policies and their implications on the economy. The outcome of this hearing could influence future tariff regulations and impact various industries across the nation.

— Curated by the World Pulse Now AI Editorial System