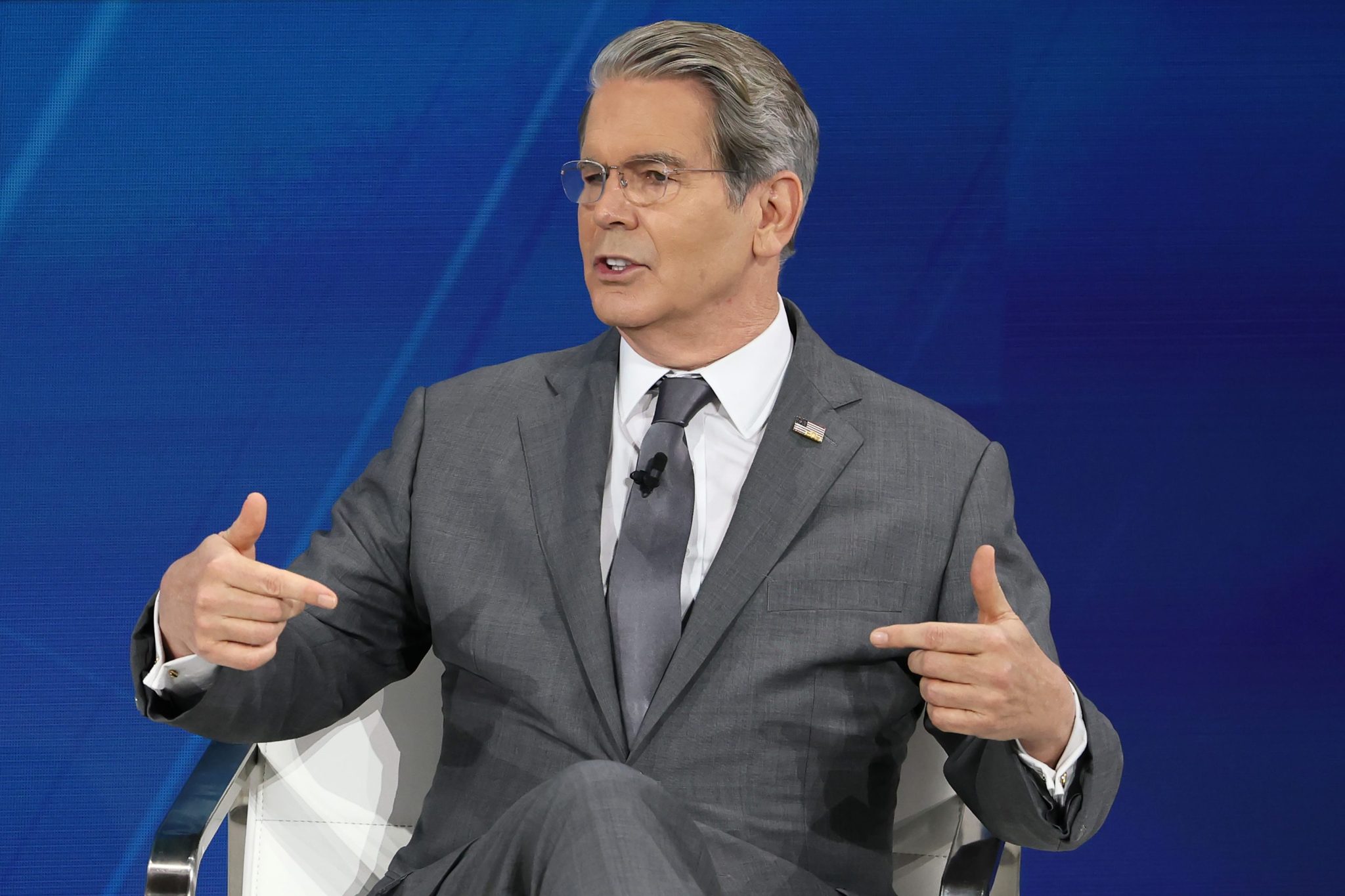

Scott Bessent calls the Giving Pledge well-intentioned but ‘very amorphous,’ growing from ‘a panic among the billionaire class’

NeutralFinancial Markets

- Treasury Secretary Scott Bessent described the Giving Pledge as well-intentioned but lacking clarity, suggesting it emerged from a sense of urgency among billionaires. He emphasized that when individuals have a stake in the system, they are less likely to undermine it, a sentiment expressed during the DealBook Summit.

- This perspective is significant as it reflects Bessent's role in shaping economic policy and addressing concerns about wealth distribution and philanthropy among the wealthy elite, particularly in the context of rising economic inequality.

- The discussion around the Giving Pledge highlights ongoing debates about the responsibilities of billionaires in society, especially as Bessent navigates pressures from former President Trump regarding economic strategies, including tariffs and interest rates, which further complicate the landscape of wealth and philanthropy.

— via World Pulse Now AI Editorial System