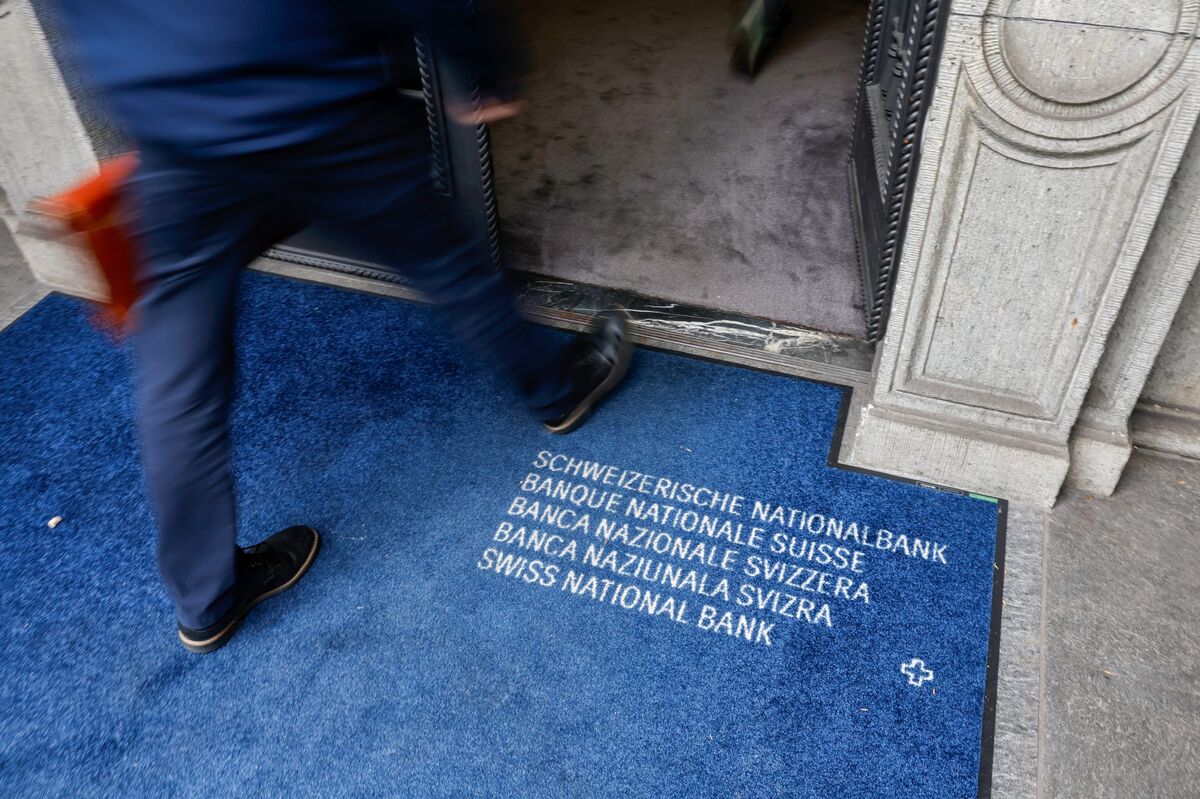

Trump tariffs led Swiss National Bank to increase foreign currency purchases

NeutralFinancial Markets

The Swiss National Bank has increased its foreign currency purchases, a move influenced by the tariffs imposed by former President Trump. This decision highlights the interconnectedness of global economies and how policies in one country can ripple through financial markets worldwide. Understanding these dynamics is crucial for investors and policymakers alike, as they navigate the complexities of international trade and currency valuation.

— Curated by the World Pulse Now AI Editorial System