S&P 500 Drops Most in Six Months on Trump Tariff Spat With China

NegativeFinancial Markets

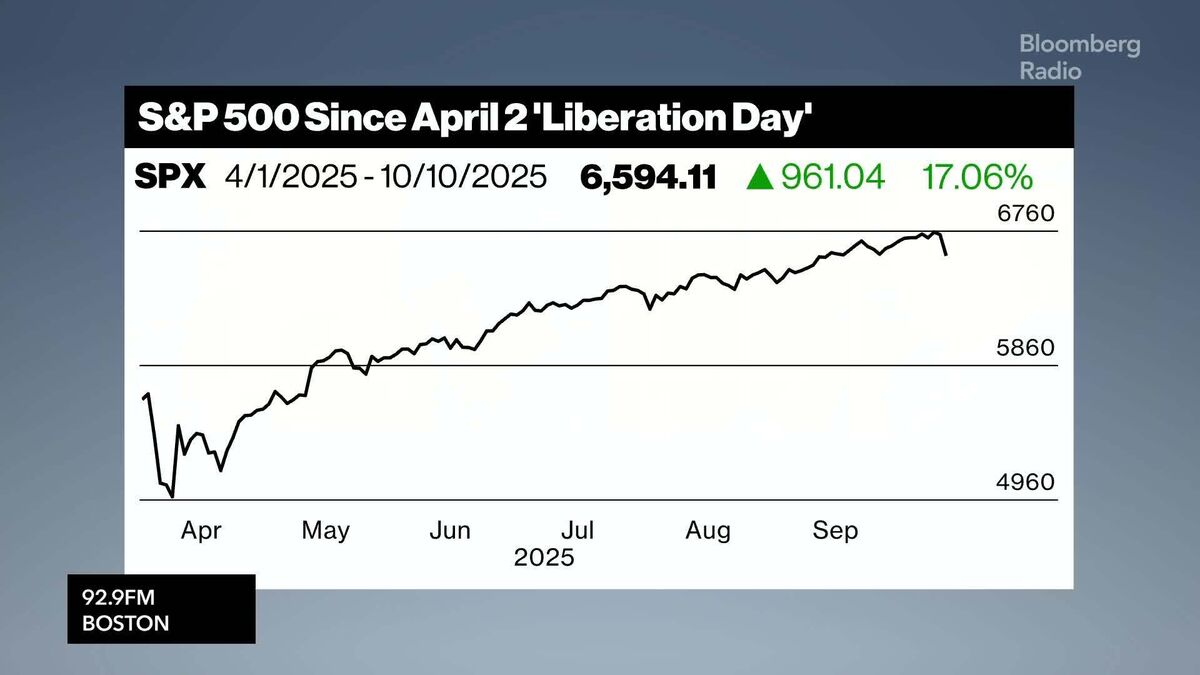

The recent threat by President Donald Trump to impose significant tariffs on Chinese imports has led to a sharp decline in US stocks, marking the worst selloff in six months for the S&P 500. This sudden downturn highlights the fragility of the market and raises concerns about the potential impact of escalating trade tensions on the economy. Investors are understandably anxious as they navigate these developments, which could have far-reaching consequences for both domestic and global markets.

— Curated by the World Pulse Now AI Editorial System