Lennar misses Q3 expectations as housing market pressures continue

NegativeFinancial Markets

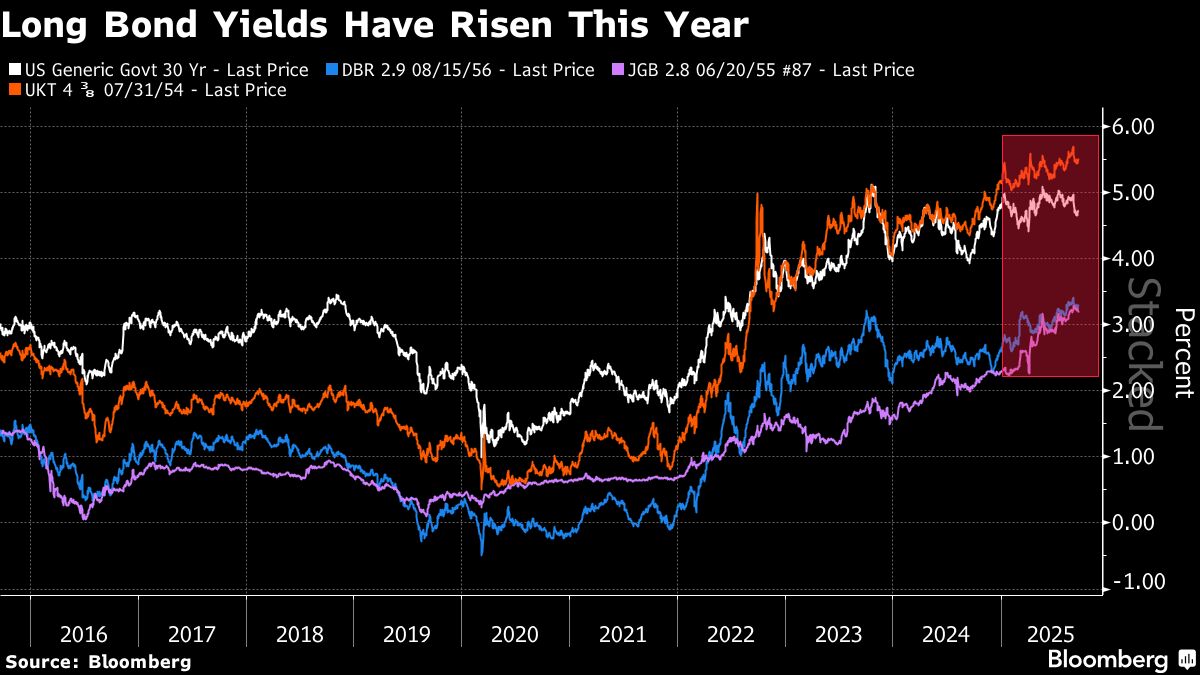

Lennar, one of the largest homebuilders in the U.S., has reported disappointing third-quarter earnings, falling short of market expectations. This news highlights the ongoing pressures in the housing market, driven by rising interest rates and affordability challenges. As a key player in the industry, Lennar's struggles may signal broader issues affecting home sales and construction, raising concerns about the future of the real estate sector.

— Curated by the World Pulse Now AI Editorial System