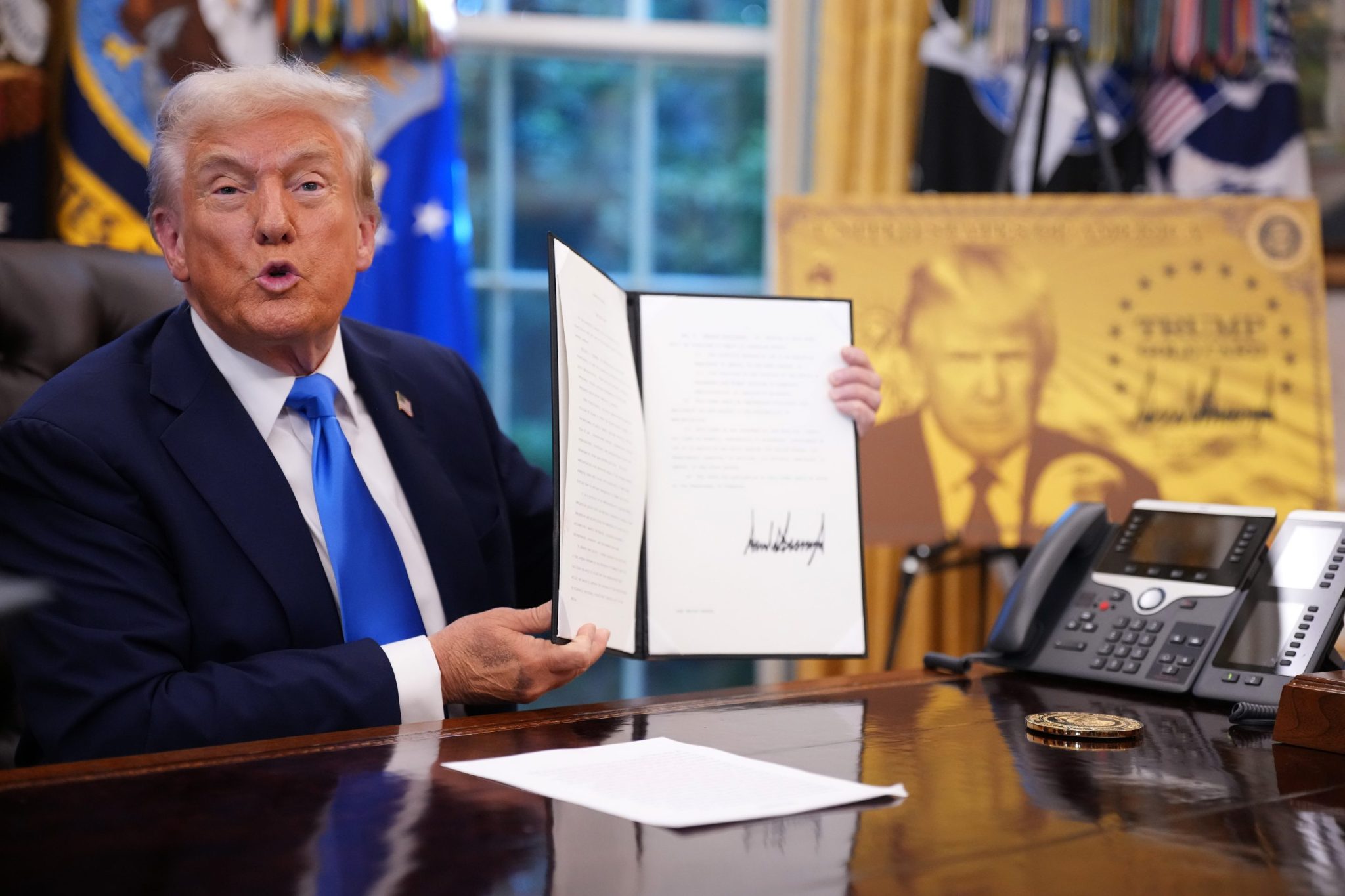

Behind closed doors, our top CEOs say Trump is bad for business and it’s time to Make America into America Again

NegativeFinancial Markets

At a recent forum hosted by the Yale Chief Executive Leadership Institute, more than 100 top business leaders expressed their concerns about Donald Trump's impact on the American economy. They believe his policies are detrimental to the country's future, highlighting a growing unease among executives about the direction of business under his leadership. This sentiment is significant as it reflects a broader apprehension within the corporate world regarding political influences on economic stability.

— Curated by the World Pulse Now AI Editorial System