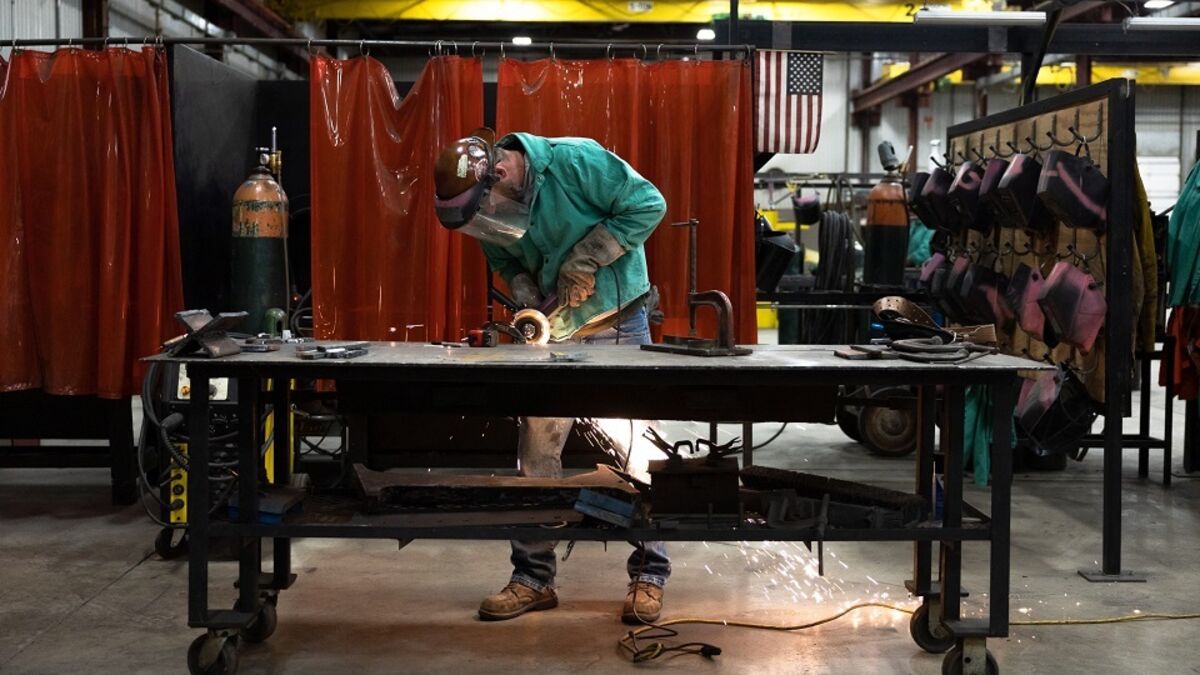

The U.S. shed 32,000 private-sector jobs in September, payroll processing giant ADP said

NegativeFinancial Markets

In September, the U.S. private sector experienced a significant setback, losing 32,000 jobs according to the ADP report. This decline highlights ongoing challenges in the labor market, raising concerns about economic stability and growth. The report serves as a crucial indicator of the health of the job market, and such losses can impact consumer confidence and spending.

— Curated by the World Pulse Now AI Editorial System