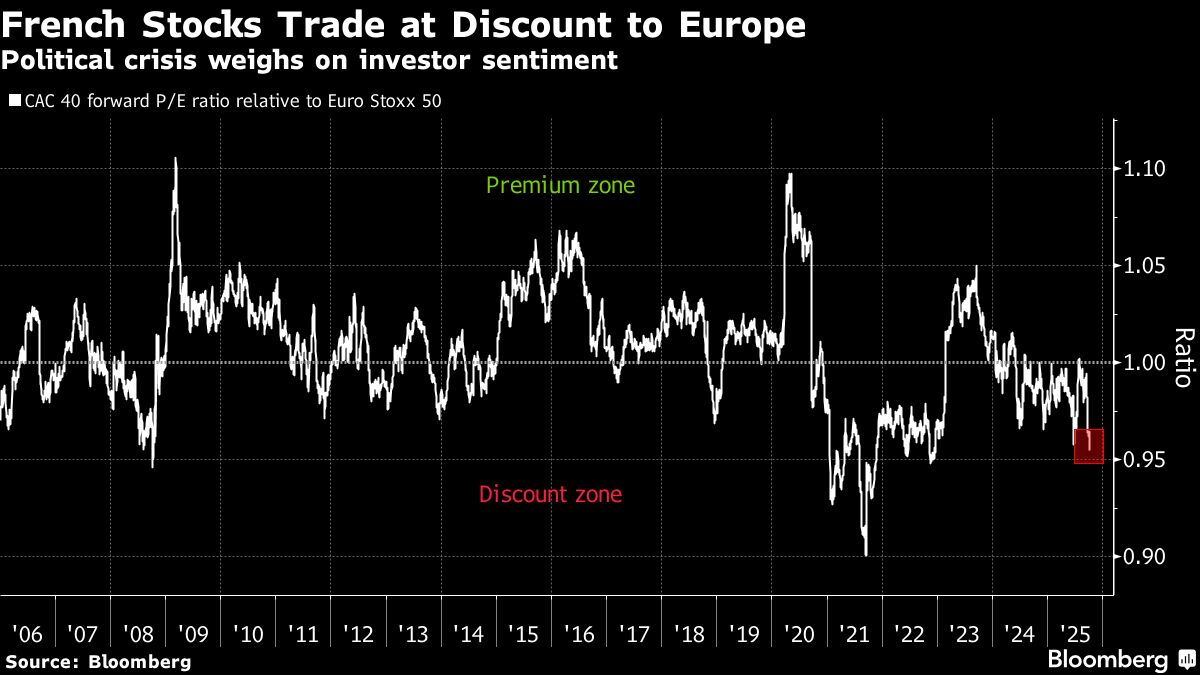

French Assets Climb As Traders Count Down to Talks Deadline

PositiveFinancial Markets

French markets are experiencing a positive uptick as the caretaker prime minister expresses optimism regarding the budget ahead of crucial talks to form a government. This development is significant as it reflects a potential stabilization in the political landscape, which could lead to more decisive economic policies and investor confidence.

— Curated by the World Pulse Now AI Editorial System