The London consensus is a timely challenge to Trump’s isolationism | Phillip Inman

NeutralFinancial Markets

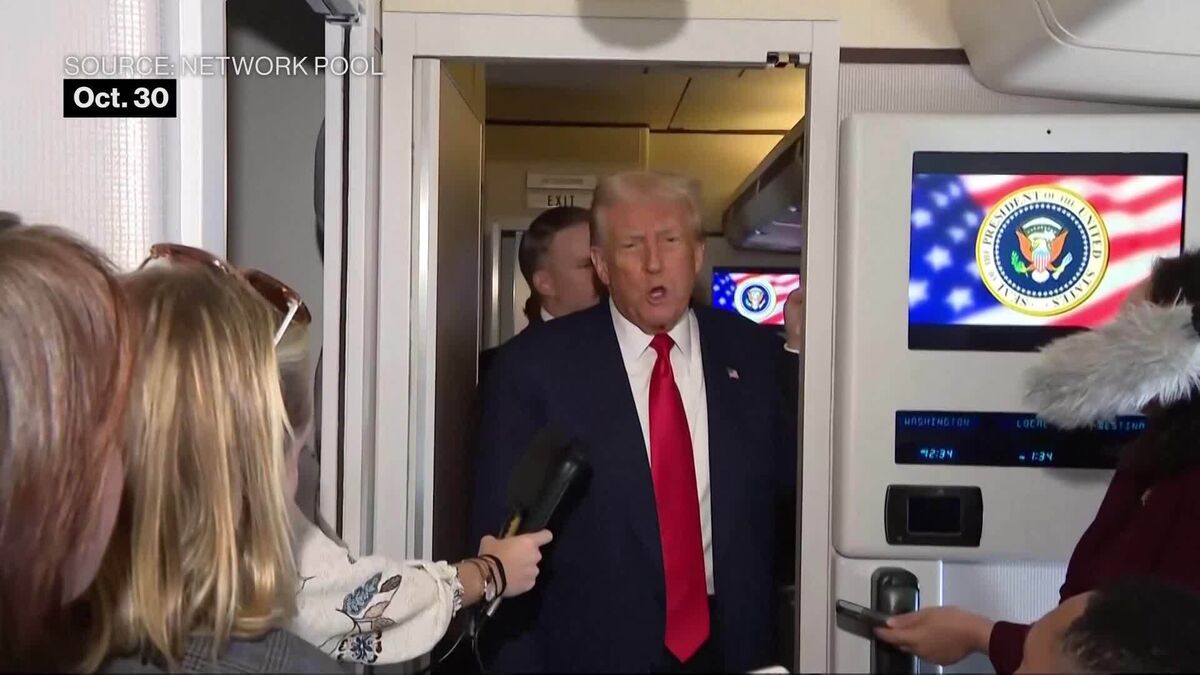

The ongoing debate about achieving fairer and greener growth is challenging the principles of neoliberal capitalism, a topic that resonates with Donald Trump. His skepticism towards free markets and liberal trade has been evident throughout his presidency, and this discussion could shape the future of economic policies. Understanding these dynamics is crucial as they may influence the direction of global economic strategies and the potential emergence of new frameworks that prioritize sustainability.

— Curated by the World Pulse Now AI Editorial System