Gold Steady After Three-Day Drop as Trade Hopes Sap Haven Demand

NeutralFinancial Markets

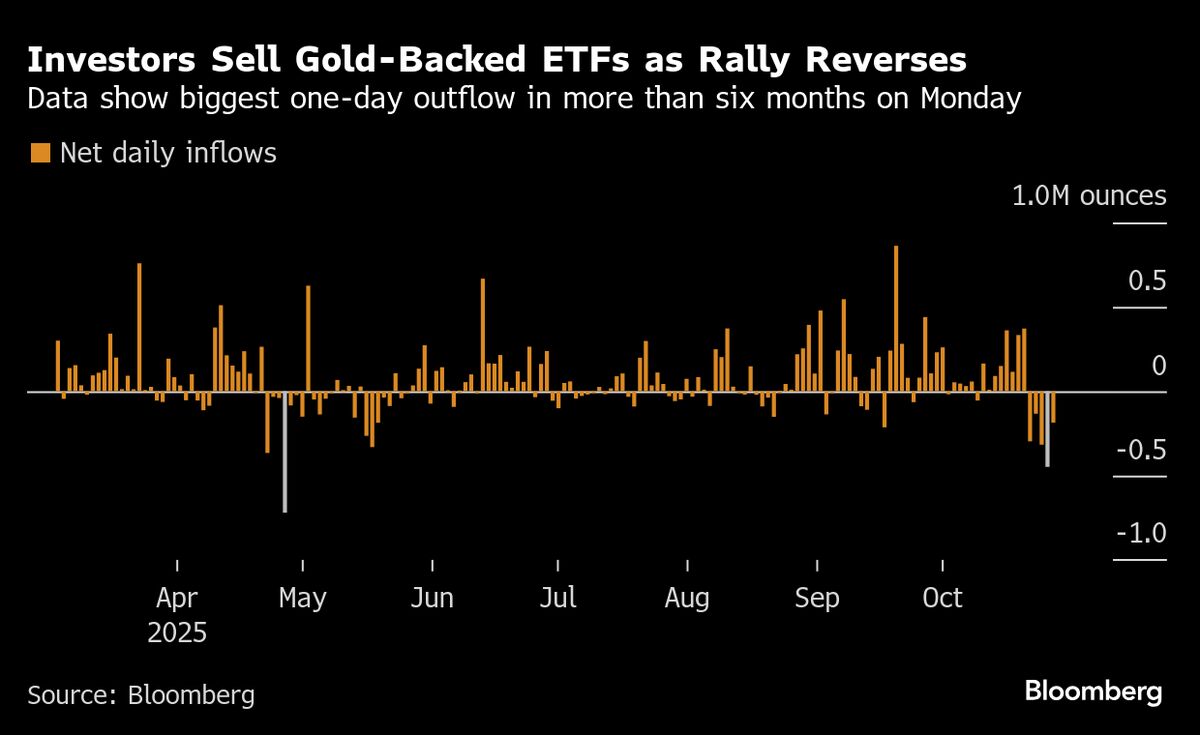

Gold prices have stabilized following a three-day decline, as investors show increased interest in riskier assets amid optimism for a potential breakthrough in US-China trade negotiations. This shift in sentiment highlights the delicate balance between safe-haven investments like gold and the allure of higher returns from riskier ventures, making it a crucial moment for market watchers.

— Curated by the World Pulse Now AI Editorial System