Switzerland Is Being Too Friendly to the US, Voters Say in Poll

NegativeFinancial Markets

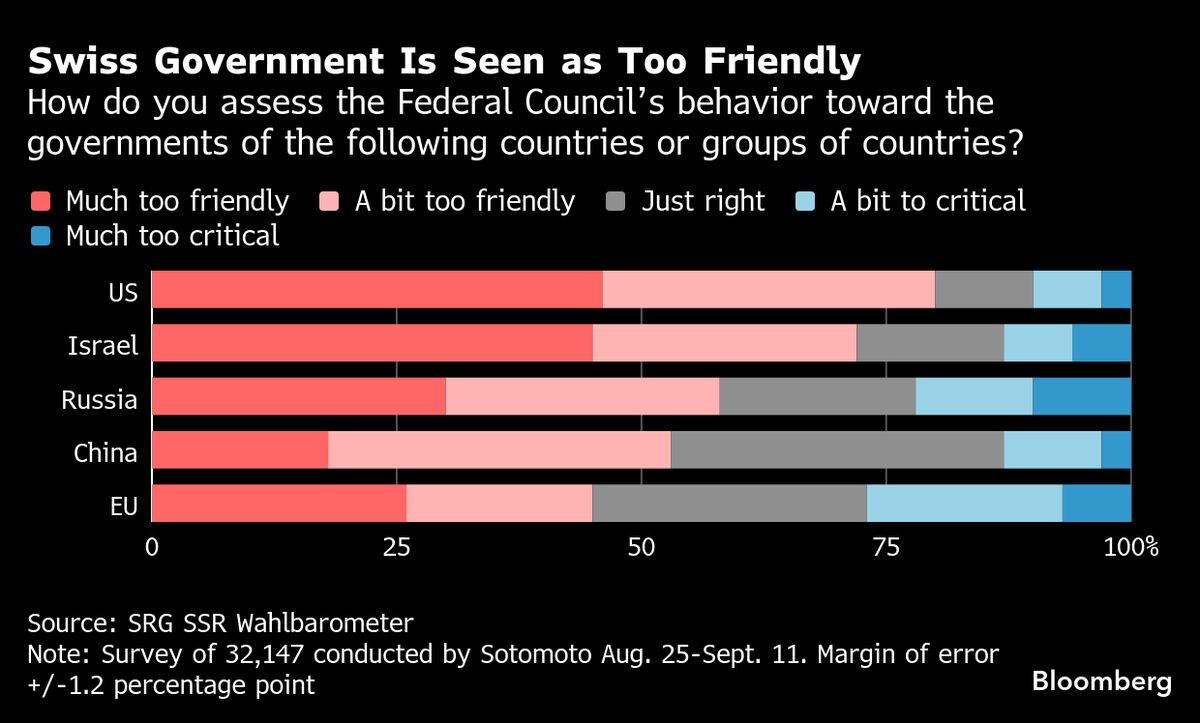

A recent poll reveals that Swiss voters feel their government is being overly accommodating to the United States, particularly in light of President Donald Trump's significant tariffs on Swiss imports. This sentiment reflects growing concerns among the Swiss populace about the implications of such trade policies on their economy and international relations, highlighting the delicate balance governments must maintain in foreign affairs.

— Curated by the World Pulse Now AI Editorial System