Japanese shares dive as market frets over premiership, US-China tensions

NegativeFinancial Markets

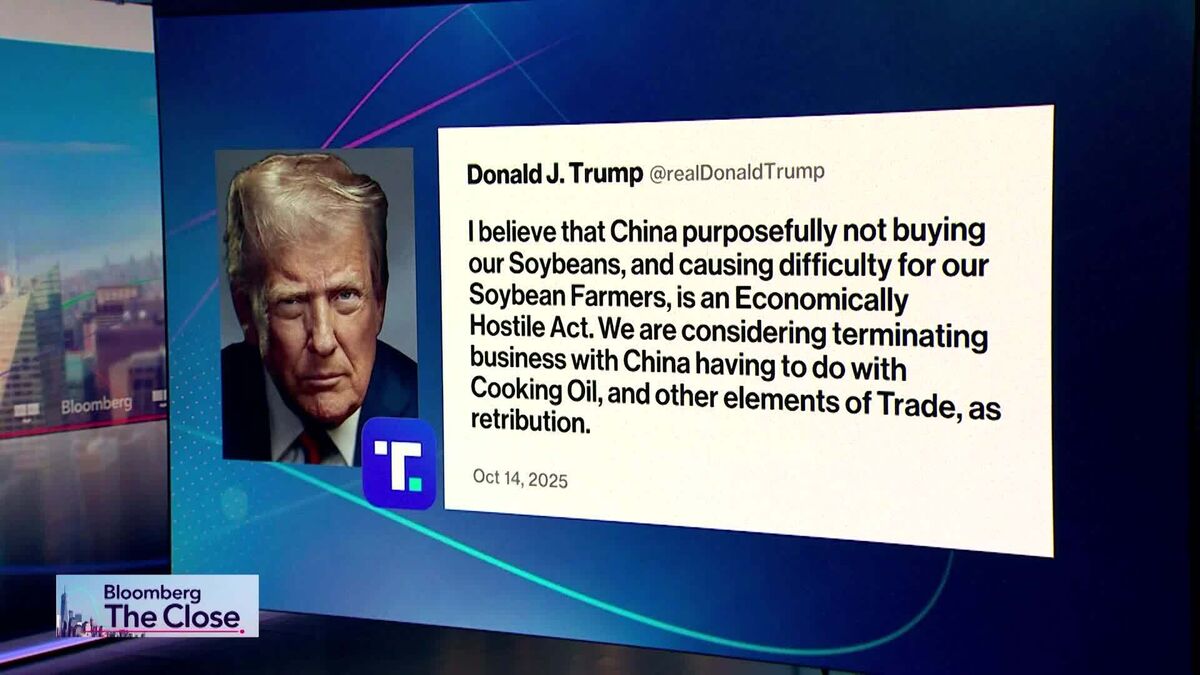

Japanese shares have taken a significant hit as concerns grow over the stability of the premiership and escalating tensions between the US and China. This downturn is crucial as it reflects investor anxiety about political leadership and international relations, which can have far-reaching effects on the economy and market confidence.

— Curated by the World Pulse Now AI Editorial System