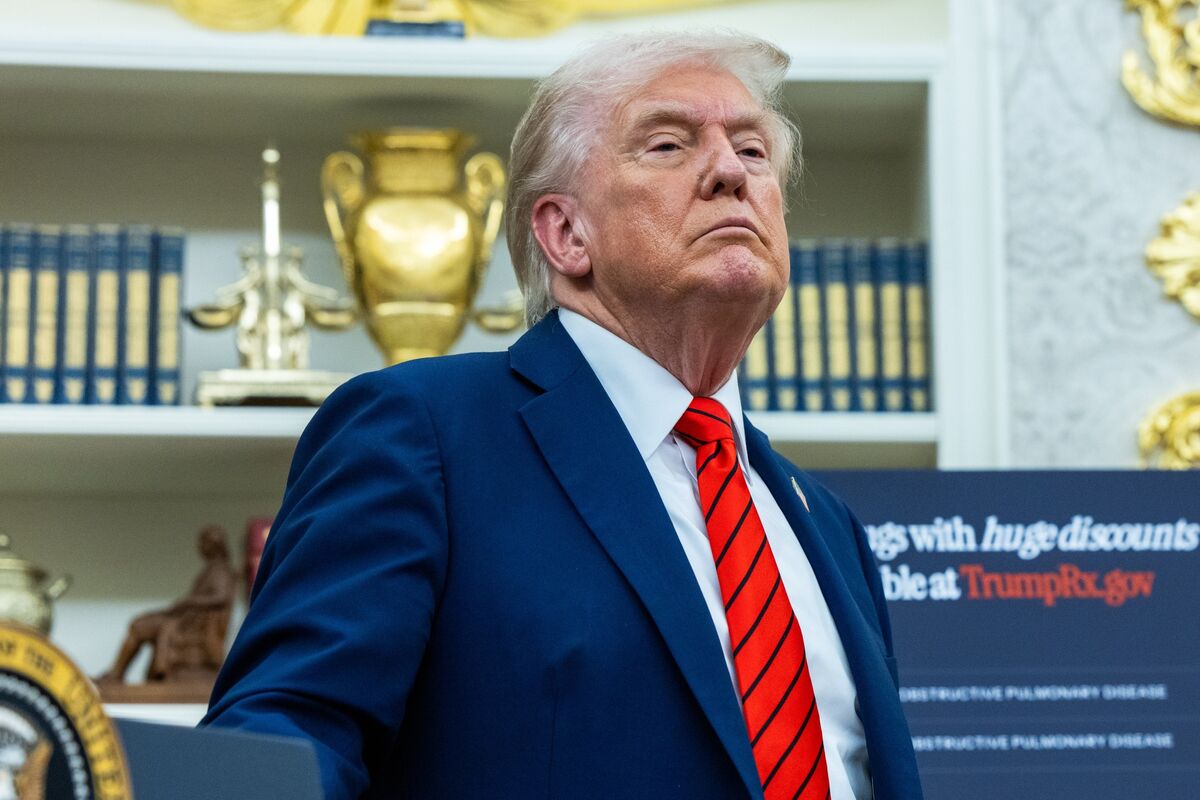

Revived US trade war knocks China’s stocks from lofty peaks

NegativeFinancial Markets

The renewed trade tensions between the US and China have led to a significant decline in Chinese stock prices, marking a stark contrast to their previous highs. This situation is crucial as it not only affects investors but also signals potential economic instability in the region, raising concerns about the broader implications for global markets.

— Curated by the World Pulse Now AI Editorial System