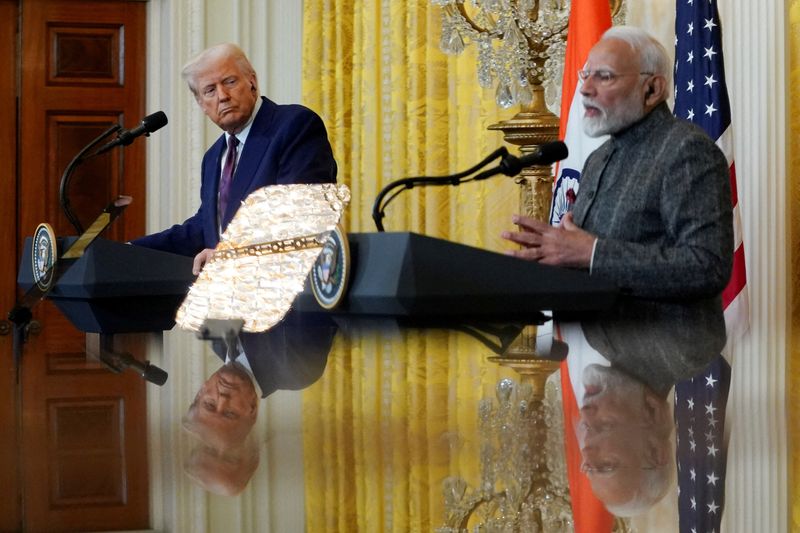

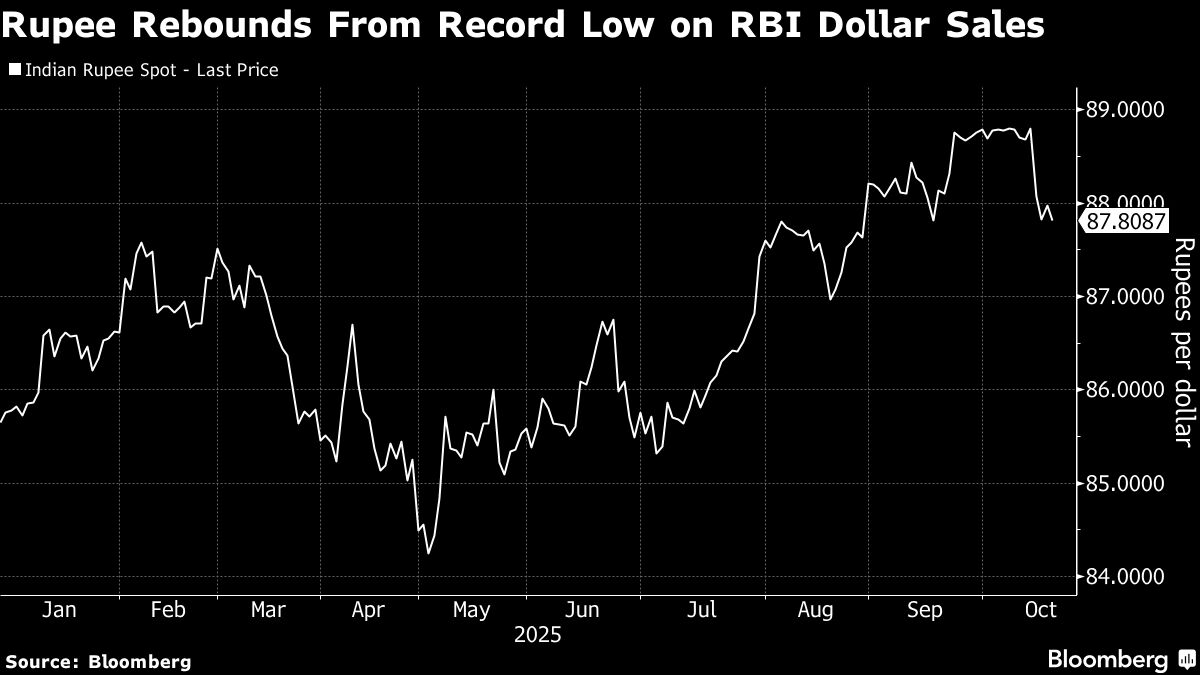

India Pushes to Expand Rupee Settlement With Key Trade Partners

PositiveFinancial Markets

India is making significant strides to enhance the use of its currency, the rupee, in trade with key partners. By allowing easier settlement of transactions in rupees, the central bank aims to strengthen the local currency and promote economic stability. This initiative not only facilitates smoother trade but also positions India as a more influential player in global markets, which could have long-term benefits for its economy.

— Curated by the World Pulse Now AI Editorial System